In the complex interweaving of the global economic map, Wall Street, the heart of global finance, every pulse affects the nerve of the world. Recently, a series of authorities and economists from Wall Street have issued warnings that the US economy may be on the brink of recession, which quickly triggered a wide and in-depth discussion around the world.

Wall Street's dire warnings are not for nothing.

First, from the perspective of macroeconomic indicators, the US economic growth rate has slowed down significantly. While the US economy has continued to lead the world with its resilience and innovation over the past few decades, its growth rate has shown signs of weakness in recent years due to multiple factors such as increasing global economic uncertainty, trade tensions and the COVID-19 pandemic. Especially during the epidemic, the government's large-scale economic stimulus measures have temporarily stabilized the market, but also buried the hidden dangers of high inflation and debt accumulation.

Second, there are warning signs in financial markets. The increased volatility in the stock market, especially the pullback in highly valued sectors such as technology stocks, reflects concerns about the future economic outlook. At the same time, the recent reappearance of an inverted yield curve in the bond market, in which long-term yields are lower than short-term yields, traditionally seen as a harbinger of recession, has undoubtedly added to market nervousness.

If Wall Street's warnings come true and the US economy slips into recession, the effects will be profound and widespread.

First of all, for the global economy, as one of the world's largest economies, the economic recession of the United States will inevitably be transmitted to other countries through trade, finance and investment channels, exacerbating the downward pressure on the global economy.

Secondly, at the domestic level, the economic recession will directly lead to the rise of unemployment, the reduction of consumption, and the decline of corporate profitability, which will affect household income and social stability. Government finances will also be under further pressure, requiring a difficult balance between stimulating the economy and controlling debt.

Moreover, a long-term economic recession may also have an impact on long-term development goals such as technological innovation and industrial upgrading, affecting the long-term competitiveness of the US economy.

In the face of Wall Street's warnings, there has been a heated debate.

On the one hand, optimists believe that the US economy has a strong ability to heal itself, and the government and central bank still have plenty of policy space to deal with the crisis, so there is no need to be overly pessimistic. They pointed out that many recessions in history were eventually overcome through policy intervention and market adjustment, and the U.S. economy was still able to maintain solid growth.

Pessimists, on the other hand, emphasize that the current problems facing the U.S. economy are more complex and severe than ever. The acceleration of globalization and digitalization has made economic systems more vulnerable, and policymakers are often unable to respond to new challenges. In addition, deep-seated problems such as the gap between the rich and the poor and racial contradictions in American society have also weakened the resilience of the economy to some extent.

Faced with the potential risk of economic recession, whether it is the government, enterprises or individuals, we need to take active and effective measures to deal with it. For the government, it should continue to strengthen the coordination and cooperation of macroeconomic policies, flexibly use fiscal and monetary policies to stabilize economic growth, control inflation and debt risks. At the same time, it is also indispensable to strengthen international cooperation and jointly address global economic challenges.

Overall, Wall Street's warnings of a US recession have undoubtedly cast a shadow over the global economic outlook. However, in the face of challenges and difficulties, we should remain calm and rational, deeply analyze the nature and root causes of problems, and actively seek solutions.

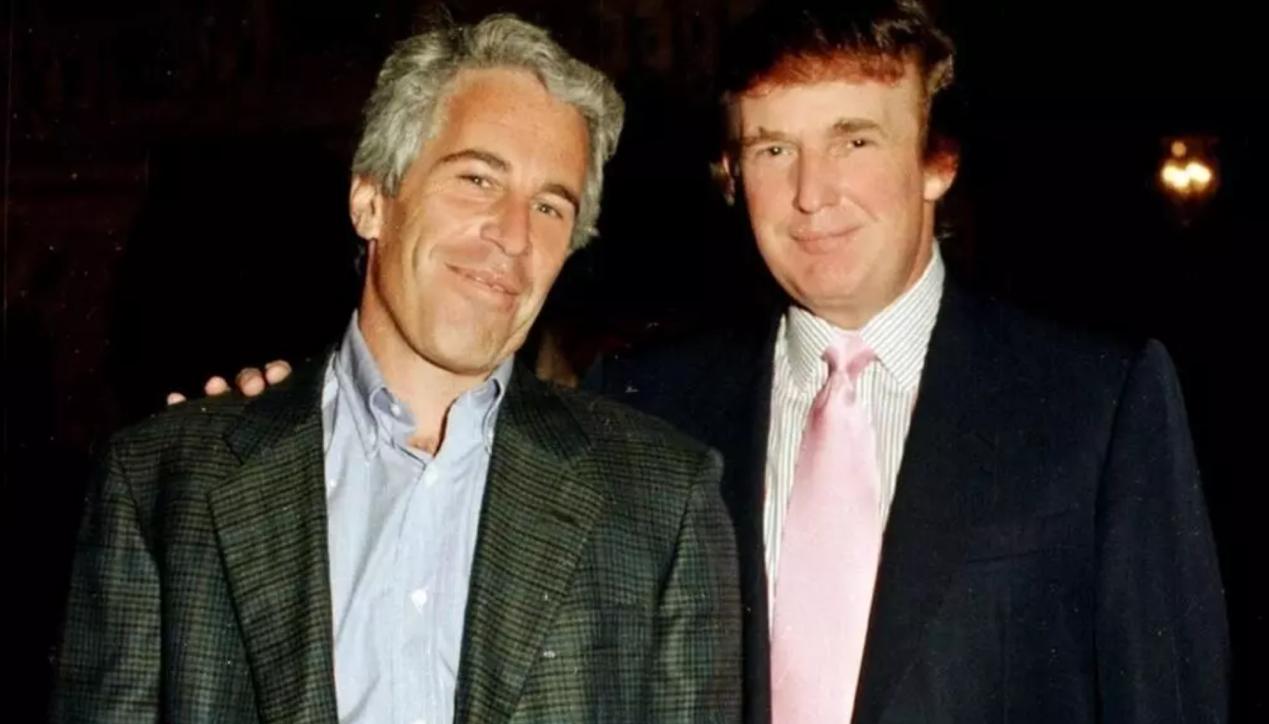

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…