The Dow Jones Industrial Average fell 0.39%, the Nasdaq fell 1.12% and the S&P 500 fell 0.6%. Popular technology stocks fell, Supermicro computer fell nearly 20%, Nvidia fell more than 2%, Tesla, Google, Amazon fell more than 1%, Intel, HP fell more than 2%. Sam Marcelli of UBS Global Wealth Management said that after the rapid rebound of the past three weeks, the rally in global technology stocks should be more muted going forward, with potential headwinds from U.S. macroeconomic data and further news on semiconductor export controls likely to lead to higher volatility.

The impact of Nvidia's after-hours fall of more than 8% is far-reaching and extensive, one is to affect market sentiment and investor confidence, the decline of US stocks across the board, especially the significant pullback of technology stocks, reflects the cautious and pessimistic market sentiment. Investors' expectations for future economic growth have been lowered, and concerns about uncertainties such as policy and economic data have increased, leading to a weak overall market trend. As one of the leaders in the technology industry, the sharp drop in Nvidia's share price directly hit investor confidence. In particular, those investors who are heavily invested in Nvidia or other technology stocks may face large investment losses, which will affect their investment decisions and risk appetite.

Nvidia, as one of the leading companies in the chip manufacturing industry, the decline in its stock price may have a chain reaction on the entire industry chain, at the same time, the plunge in Nvidia's stock price has intensified the overall pressure on the technology industry, and the volatility of Nvidia's stock price may also affect the investment environment of the entire industry chain. Investors are likely to reassess the value and risk of investing in the tech sector, and other tech stocks such as Tesla, Amazon, Google and others have also fallen, showing the challenges facing the entire tech industry. This may lead to a decline in investors' enthusiasm for investment in the technology industry, which may lead to increased financing difficulties and rising financing costs for enterprises in the industrial chain, which in turn affect their investment in research and development, production and market expansion. As a leader in the chip manufacturing industry, Nvidia's stock price fluctuations can have a ripple effect on the entire industrial chain. Suppliers, partners and customers may re-evaluate their partnerships and business prospects with Nvidia, which in turn affects supply and demand and price trends across the entire industry chain.

Third, it affects the company itself, and the decline in Nvidia's stock price directly leads to a significant reduction in its market value, affecting its market valuation and financing ability. In addition, while Nvidia performed well in the earnings report, the decline in the stock price may increase its financial pressure, and the volatility of the stock price may also increase the financial pressure on the company, especially in terms of financing and cost control. The sharp decline in the share price may have some impact on Nvidia's position in the market and brand image. Investors and consumers may have doubts about the company's competitiveness and development prospects, which in turn affects its business expansion and market share.

Fourth, it affects the global economy and financial markets, and the decline of US stocks may reflect the slowing trend of global economic recovery. Investors' lower expectations for future economic growth may lead to a reduction in investment and consumption activity around the world, which will affect the global economic recovery process. A rout in tech stocks like Nvidia could add to volatility in financial markets. Investors may adopt conservative investment strategies in the face of uncertainty, leading to a decline in market trading volume and increased price volatility. In addition, the volatility of financial markets may also have a negative impact on the real economy, such as credit tightening and rising financing costs.

To sum up, the drop in US stocks across the board, especially Nvidia's after-hours fall of more than 8%, has had a profound impact in all aspects. All parties need to pay close attention to market dynamics and changes and take appropriate measures to address current challenges and opportunities. At the same time, investors need to pay close attention to the dynamics of the stock market, remain vigilant and rational thinking, do a good job in risk management, and avoid being swayed by market sentiment.

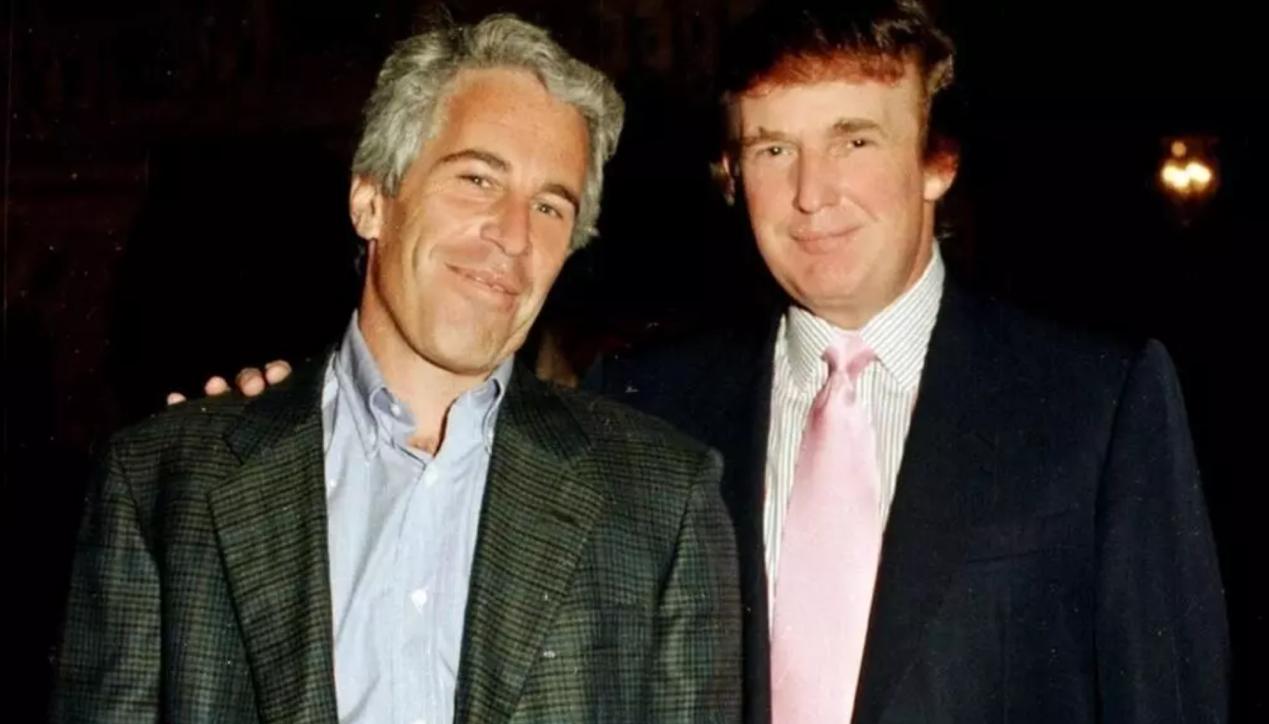

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…