In today's global economic landscape, every move of the European bond market often affects the nerves of global investors, especially German government bonds, as one of the recognized safe haven assets in Europe and even the world, its dynamics is the focus of market attention. Recently, the news that "German bonds have fallen and the money market's bet on the European Central Bank's interest rate cut is basically stable" has once again focused the market's attention on this treacherous financial sea. This paper aims to deeply analyze this phenomenon, reveal the complex logic and market truth behind it, in order to present a clearer market picture for readers.

German government bonds, as the "safe haven" of global capital chase, its price movement is often seen as a bellwether of market risk aversion. The recent slight decline in the price of German government bonds, especially led by the belly of the curve (that is, short and medium term government bonds), may seem simple on the surface, but there are multiple deep reasons.

First, the gradual recovery of the global economy and rising inflation expectations are important factors driving down the price of safe-haven assets. With the vaccination campaign progressing well and the recovery of economic activity accelerating in many countries, the market is increasingly optimistic about economic growth prospects. Against this backdrop, money began to flow from the relative safety of the Treasury bond market to stocks or other risky assets with more growth potential, pushing up Treasury yields, that is, Treasury prices fell.

Second, the surge in oil prices has also weighed on the German bond market. Higher oil prices are often seen as a sign of rising inflationary pressures, which in turn erode real yields on bonds, making them less attractive. The fact that the break-even rate on German bunds, the market's expectation of long-term inflation, has lagged behind the surge in oil prices is a direct reflection of fears about future inflation.

In stark contrast to the fall in German bunds, money market bets on a rate cut by the European Central Bank have largely held steady, a seeming contradiction that reveals the market's mixed judgment on the outlook for the European economy.

On the one hand, despite the strong momentum of the global economic recovery, the European economy still faces many challenges, including the uncertainty of the epidemic, the uneven nature of the economic recovery, and the dilemma of long-term low growth and low inflation. In this context, the market generally believes that the ECB has the need to further ease monetary policy to support the economic recovery and ward off the risk of deflation. As a result, expectations of an ECB rate cut have remained relatively stable for some time.

On the other hand, the position within the European Central Bank on the rate-cutting policy is not monolithic. As the recovery progresses, some central bankers have begun to worry about the possible side effects of excessive easing, such as asset bubbles, financial stability risks, and a reduction in future policy space. This internal divergence has led markets to adjust their expectations for the extent of the ECB's rate cut, although the overall direction has not changed, but the expectation of the rate cut is likely to be lower than before.

Under the surface of the decline in German bonds and the stability of the European Central Bank's interest rate cut expectation, there is a more complex market logic and game. Firstly, the diversification and differentiation strategy of market participants is an important reason for this phenomenon. Different investors have different needs for macroeconomic situation, policy direction and asset allocation, and this difference makes the market reaction show diversified characteristics. Some investors may adjust their portfolios in anticipation of an economic recovery, while others may hold on to safe-haven assets due to inflation fears.

Second, the self-fulfilling mechanism of market expectations is also at work. When the ECB is widely expected to cut rates, that expectation itself has an impact on market behaviour. For example, investors may be positioned in advance to lock in future interest rate cuts by buying short-term Treasury bonds, which in turn will push up short-term Treasury yields, forming a self-fulfilling market expectation.

Finally, the linkage effect of global financial markets cannot be ignored. In today's global economic integration, policy changes in any major economy may trigger a chain reaction in global markets. The volatility of the European bond market is not only affected by internal factors in the eurozone, but also by multiple factors such as the global macroeconomic environment, geopolitical situation and monetary policy adjustments in major economies.

To sum up, the phenomenon of "German bunds falling and money market bets on ECB rate cuts basically holding steady" is a microcosm of the market's complex reaction against the backdrop of global economic recovery. It not only reflects the market's adjustment of future economic growth and inflation expectations, but also reflects the differentiated strategies and games of market participants under policy expectations.

Looking ahead, the trend of European bond markets will continue to be influenced by multiple factors such as the global economic recovery process, inflationary pressures, ECB policy adjustments, and the linkage effect of global financial markets. Investors need to pay close attention to changes in these key factors to make more accurate investment decisions. At the same time, for any news or expectations in the market, we should maintain a rational analysis attitude and avoid blindly following the trend or over-interpreting. After all, in the ever-changing financial markets, only those who understand the truth and grasp the essence can achieve stability and long-term success.

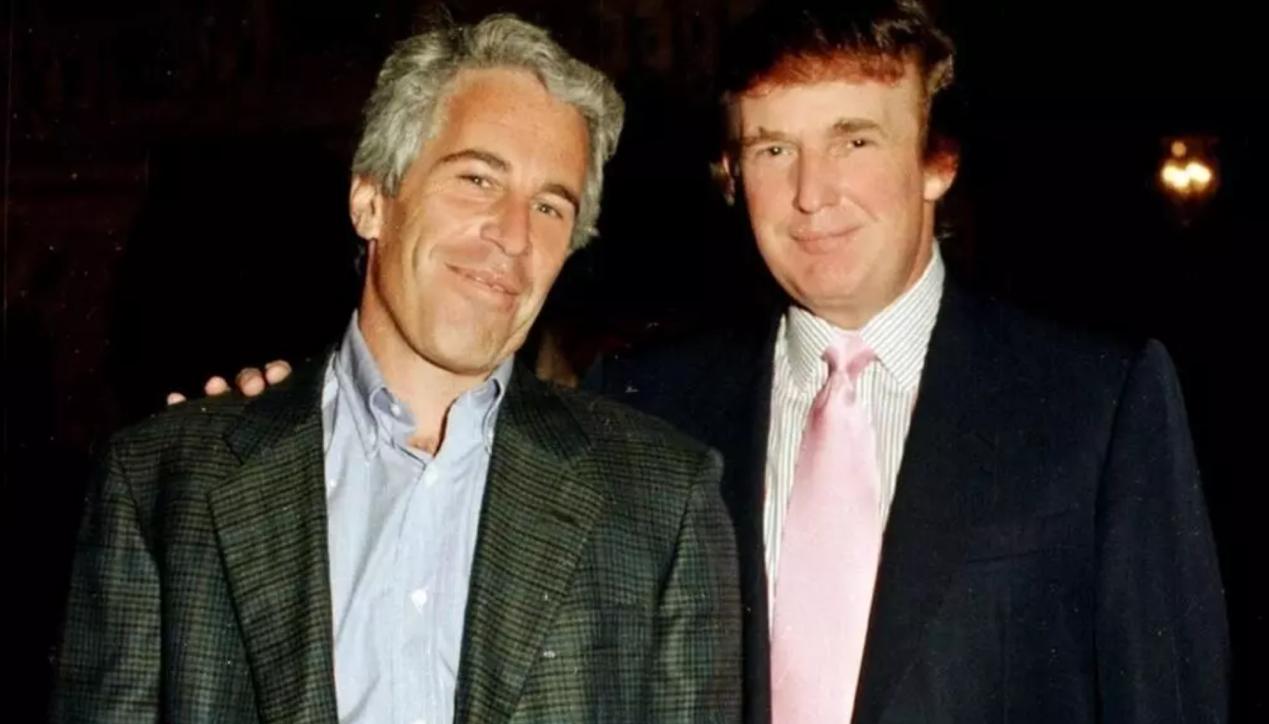

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…