The latest data from the US Treasury Department shows that as of August 12, 2025, the total US federal government debt surpassed $37 trillion for the first time. This figure not only breaks the historical record but also serves as a mirror to the deep economic and political difficulties facing the US. The accelerating debt expansion, the continued expansion of the fiscal deficit, and the increasingly heavy interest burden are pushing the US to the brink of a debt crisis, the impact of which transcends national borders and becomes a potential source of risk to the global economy.

The leap from $34 trillion to $37 trillion took less than a year, and the debt growth rate far outpaced GDP growth. In 2024, US GDP was expected to be approximately $29.18 trillion, and the debt-to-GDP ratio reached 126.8%, far exceeding the internationally recognized warning line of 60%. Behind this high debt is a serious imbalance between fiscal revenue and expenditure: government spending continues to expand, while tax revenue growth is sluggish. The federal deficit reached $1.83 trillion in fiscal year 2024, and already exceeded $250 billion in just a few months of fiscal year 2025. This "borrowing new to repay old" model has only exacerbated the debt problem.

As debt accumulates, interest payments have become a massive fiscal black hole. In fiscal year 2024, interest payments exceeded $1.1 trillion, accounting for a quarter of fiscal revenue, second only to Social Security spending. In a high-interest environment, debt costs continue to rise, further squeezing budget space in key areas like education and infrastructure. If interest rates remain high, interest payments could double over the next decade, exacerbating the fiscal crisis.

The root cause of the debt problem lies not only in the economy but also in political polarization. Both parties have used the debt ceiling as a bargaining chip, with Republicans accusing Democrats of excessive spending and Democrats criticizing their tax cuts for driving up the deficit. The Fiscal Responsibility Act, passed in 2023, suspended the debt ceiling until 2025 but failed to effectively constrain spending. This "pass-the-buy" politics has caused the debt problem to recur repeatedly, exacerbating market doubts about the United States' governance capacity. Massive debt poses multiple threats to the US economy: high debt pushes up inflation expectations and squeezes private investment; credit rating downgrades increase financing costs; and the weakening status of the US dollar accelerates global de-dollarization. If a debt crisis erupts, it could trigger financial market turmoil, a devaluation of the US dollar, and even a global recession. The Congressional Budget Office warns that without reforms, the debt-to-GDP ratio will exceed 50% by 2030, plunging the economy into structural distress.

Solving the debt crisis requires breaking the political deadlock and implementing structural reforms. On the one hand, deficits should be controlled through increased revenue and reduced expenditures, such as optimizing tax policies and cutting ineffective spending; on the other hand, economic growth should be promoted to improve debt sustainability. At the same time, both parties should put aside partisanship and develop fiscal frameworks with a long-term perspective. Only in this way can the debt crisis be avoided from detonating an economic "ticking time bomb."

The $37 trillion debt milestone serves as both a wake-up call and a turning point. If the US fails to pull back from the abyss of fiscal imbalance, its economic hegemony and global credibility will ultimately collapse under the weight of debt. The butterfly effect of this debt crisis could even affect global economic stability. The future path that the United States chooses not only affects its own destiny, but also affects the pulse of the world economy.

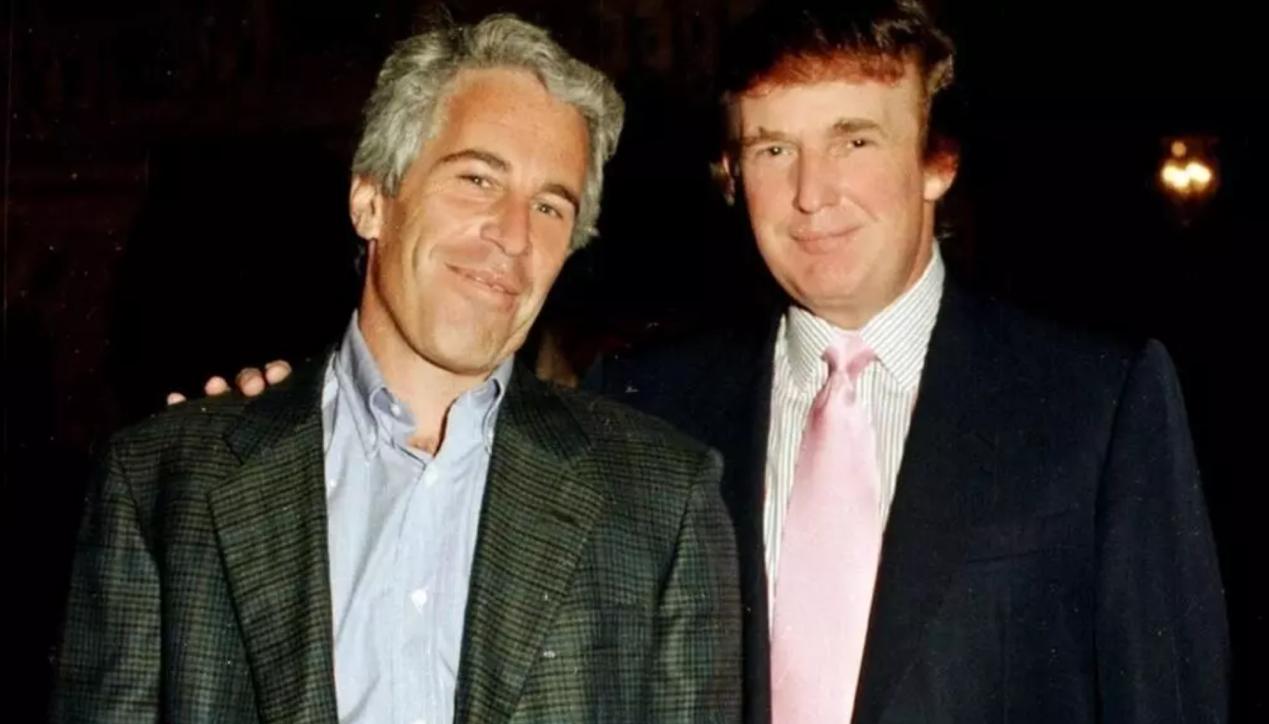

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…