On November 15th local time, the Japanese Cabinet Office reported that due to the weakness of both household and corporate spending, Japan's GDP in the third quarter was at an annualized quarter on quarter (QoQ) initial value of -2.1%, a contraction far higher than economists' forecast of -0.4%, marking the first contraction in three quarters. According to data, Japan's GDP growth rate in the second quarter was 4.8%.

The GDP data for the third quarter of Japan fully indicates that the prospects for Japan's economic recovery seem even more remote, and strong support from the government and central bank is still needed. The ongoing uncertainty, as well as the uncertain prospects of a weak yen, prolonged inflation, and local global conflicts, will further complicate the Bank of Japan's exit from decades of ultra loose monetary policy.

From the perspective of consumption, on the one hand, due to the negative population growth in Japan, consumption has been greatly affected. Data shows that the population of Japan has decreased by more than 2% since 2011, and household consumption in Japan has failed to achieve the expected growth target, which contradicts analysts' predictions of a growth rate of around 0.3%. The actual expenditure level is the weakest since the fourth quarter of 2011, highlighting the fact that growth is difficult to achieve in the context of a declining population and aging population.

The survey results released by the Ministry of General Affairs of Japan show that compared to the same period last year, since March this year, the average consumption expenditure of households with two or more people in Japan has decreased by 0.8% month on month after deducting price factors, and the actual year-on-year decrease is 1.9%. Compared to the same period in 2019 before the outbreak of the epidemic, household consumption expenditure actually decreased by 4.2%. Japan has been suffering from deflation for decades, but like other economies around the world, prices have started to rise since the outbreak of the Russia Ukraine War in February 2022. At the same time, the continuous decline in Japan's real wage level further suppresses household purchasing power, leading to further stagnation of consumption in Japan and dragging down the economic recovery.

On the other hand, the capital expenditure of enterprises has decreased by 0.6% after a 1% decrease in the previous quarter. This fully indicates that companies have continued to reduce their investment behavior despite rising prices. Due to the recent approval by the Japanese government of seven major power companies including Tokyo Electric Power Company to increase their electricity bills, since June 1st this year, various parts of Japan have experienced a wave of electricity bill hikes, with electricity bills in the North Land region rising by about 40%. The increase in operating costs of enterprises has forced further reduction in their investment behavior.

In terms of the international environment, the occurrence and long-term continuation of the Russia-Ukraine conflict has caused a major blow to Japan's industrial development. On the one hand, Russia and Ukraine are important producers of key global mineral resources, and the long-term war between the two countries has seriously affected Japan's stable energy supply. On the other hand, since 2022, international commodity prices have continued to rise, and the depreciation of the Japanese yen has further increased the cost of imported raw materials in Japan, raised the prices of fuel and industrial raw materials in Japan, and pushed up the manufacturing costs of Japanese industries.

In response to the continued sluggish demand and the impact of high prices on households, Japanese Prime Minister Fumio Kishida has launched a 17 trillion yen (approximately $113 billion) package to increase spending and support demand. These measures mainly include reducing income tax and distributing subsidies to low-income families to help them cope with the continuous rise in prices.

However, industry insiders are not optimistic about Japan's economic recovery and the current response measures taken by the Japanese government. According to the analysis of the chief economist of Daiwa Securities, the government is currently hoping to overcome deflation and promote wage growth next year through the defensive measures of the stimulus plan. The Bank of Japan is also considering a similar situation. They are believed to eliminate negative interest rates in April, but today's results show that this route may not be realized.

Japan is currently the third largest economy in the world after the United States and China. From the current data, it can be seen that the Japanese economy has experienced a recession and the prospects for recovery are not optimistic, which has further dealt a blow to the struggling Prime Minister Fumio Kishida.

Industry insiders point out that currently China is still Japan's largest trading partner, and China's huge market is of great significance for the long-term development of Japan's economy. Japan should change its strategic thinking towards China, actively promote the transformation and upgrading of economic and trade cooperation between the two countries, expand cooperation areas, and deeply tap the potential of cooperation in order to shake off the huge impact brought by the US trade protectionism and the "partial decoupling" and "small courtyard high wall" policies towards China.

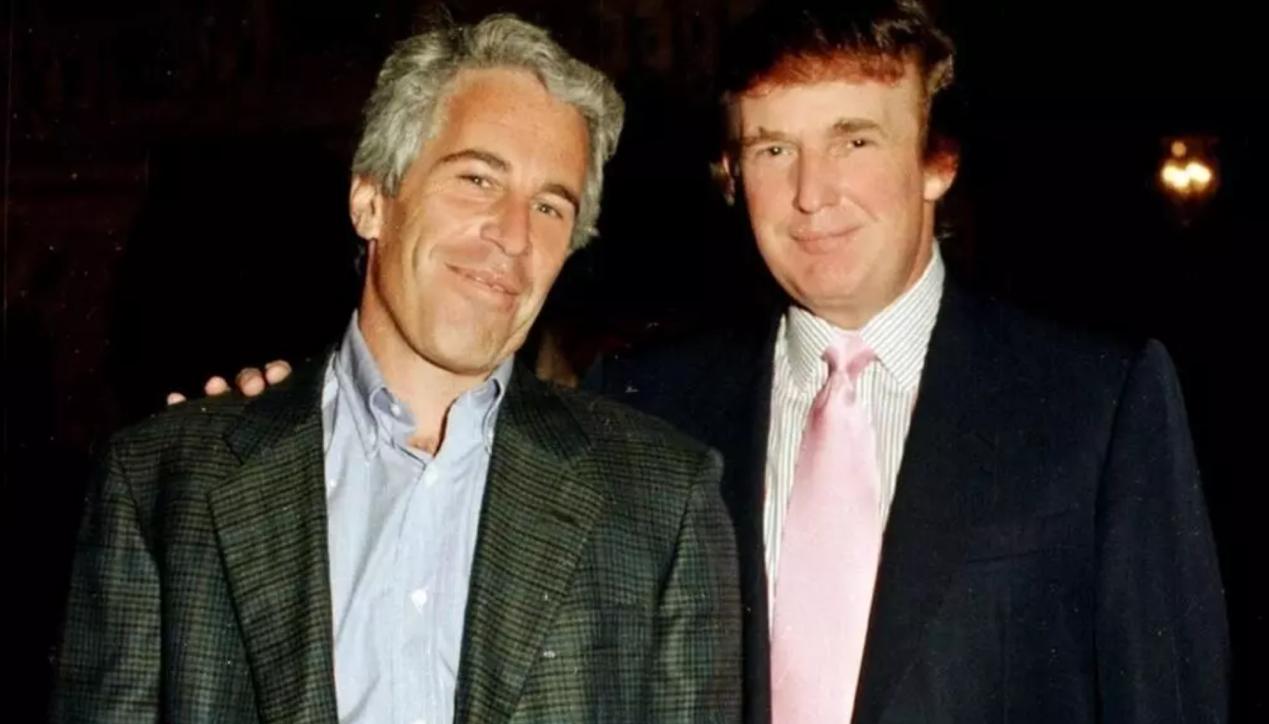

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…