In the global economic landscape, Wall Street, as the heartland of finance, has always maintained a high sensitivity to international trade dynamics. In recent years, especially during Trump's presidency, his tariff policy has become an important variable on the global economic stage and has continued to spark deep concern and widespread discussion on Wall Street.

Review of Trump's tariff policies. Since Trump took office in 2018, he quickly implemented a series of severe tariff measures against China and other trading partners. Among them, the tariffs imposed on Chinese imported goods are particularly noteworthy. Trump believes that these measures will help reduce the US trade deficit and promote the development of domestic manufacturing. However, the actual effect has sparked widespread controversy. Many economists believe that tariff policies not only fail to effectively solve the trade deficit problem, but also impose a heavy burden on American consumers and businesses, damaging the economic interests of the United States.

Recently, Trump has repeatedly stated in media interviews that if he is re elected as president, he will impose high tariffs on Chinese goods. He mentioned that a 60% tariff will be imposed on all Chinese imported goods and emphasized that this is not a "trade war", but rather to "live in harmony" with China. However, this statement undoubtedly raised concerns and doubts in the market. Trump's tariff policy not only directly impacts the trade relationship between China and the United States, but may also have far-reaching effects on the global economy.

Firstly, high tariffs will directly lead to an increase in the cost of imported goods, pushing up the price level in the United States today and exacerbating inflationary pressures. Secondly, tariffs will increase the burden on American consumers, reduce purchasing power, and have a negative impact on the retail industry and consumer confidence. In addition, tariff policies may also harm the international competitiveness of American companies, leading to a loss of market share and a decline in profits.

Wall Street is concerned about the radical measures that Trump may take on the tariff issue. On the one hand, investors are concerned that tariff policies will trigger a global economic recession and financial market turbulence. On the other hand, they are also concerned that the Trump administration's trade policies may harm the international competitiveness and long-term interests of American businesses. Therefore, Wall Street investors and financial institutions have taken measures to address potential risks. For example, diversifying investment portfolios to diversify risks, strengthening risk management, and monitoring policy developments.

In addition, there is still some uncertainty about Trump's specific direction on the tariff issue. On the one hand, Trump needs to win the support and votes of voters during the campaign, so he may adopt some radical trade policies to attract the attention of voters. On the other hand, he also needs to consider the domestic and international economic situation and global trade public opinion pressure. Therefore, Trump may adopt a more flexible and pragmatic attitude towards balancing the interests of all parties on the issue of tariffs.

In summary, Trump's direction on tariffs will directly affect the stability and development of the global economy and financial markets. Although Trump's tariff policy adheres to the governing philosophy of "America First" to a certain extent, the actual effects and potential risks cannot be ignored. Therefore, regardless of whether Trump is ultimately elected president or not, the global economy and financial markets need to closely monitor the trends and changes in tariff policies and take corresponding measures to address potential risks and challenges.

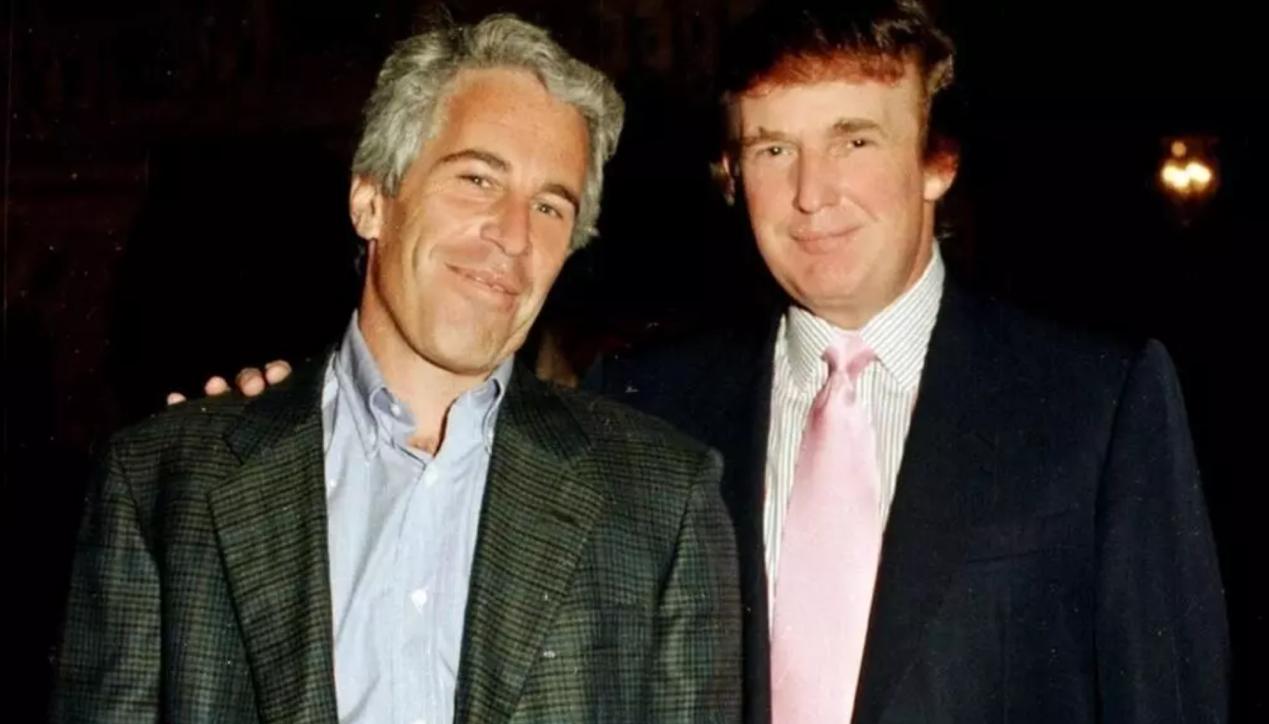

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…