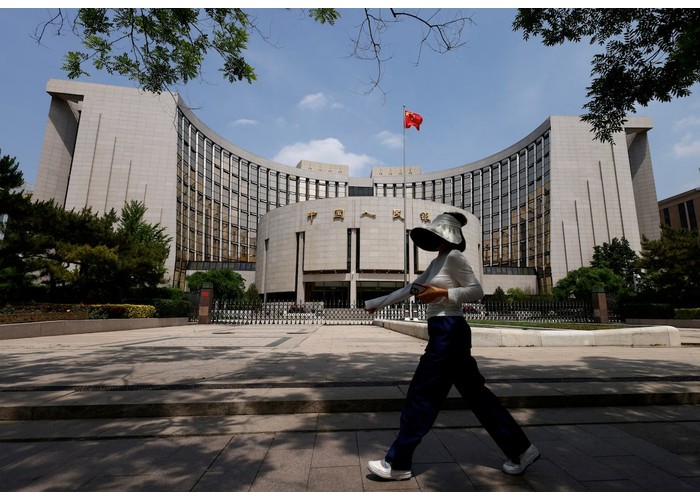

Economic Adjustment Under the Shadow of Trade War: Strategies and Impacts of China's Key Interest Rate Cut

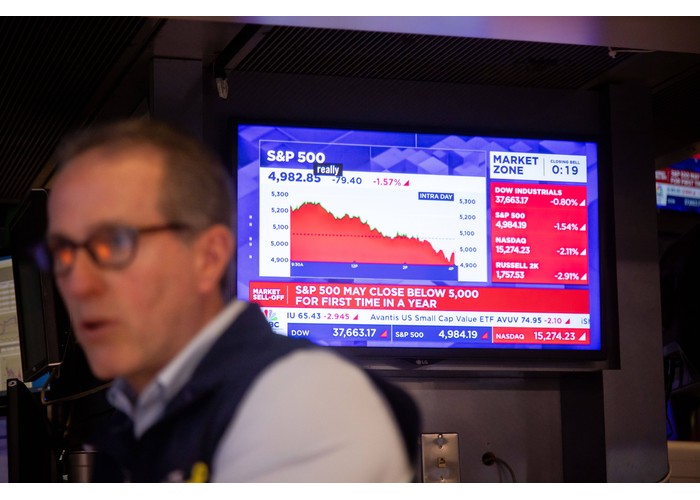

The series of tariff policies implemented since Trump took office have further escalated global economic and trade tensions, significantly impacting the economic policies and market expectations of countries worldwide under the influence of U.S. tariff measures. Among these, the tariffs imposed on China were particularly severe.

more