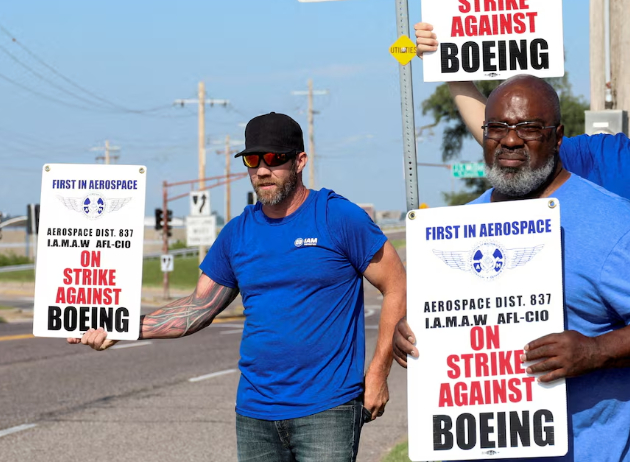

After nearly three months of strike action, Boeing workers again overwhelmingly rejected management's latest labor contract proposal. Data from the International Association of Machinists and Aerospace Workers (IAM) shows that 64% of voters opposed the agreement, marking a further escalation in the labor-management conflict that began in September 2024. The strike has halted production lines for core Boeing models, including the 737, leading to losses exceeding $6 billion in the third quarter and heightened risks of layoffs and credit rating downgrades. Deeper tensions have surfaced: workers' insistence on pension rights clashes with the company's financial pressures, reflecting the structural difficulties in labor-management relations in the US manufacturing industry.

The strike stems from sharp disagreements between Boeing and the union over wages, benefits, and working conditions. Since the beginning of 2024, following the frequent quality issues with the 737 MAX and the company's deteriorating financial situation, Boeing has attempted to maintain operations through cost cuts. However, workers are deeply dissatisfied with slow wage increases, frozen pensions, and deteriorating working conditions. On September 13, 33,000 West Coast workers voted to strike, forcing Boeing to restart negotiations.

Boeing had proposed several wage increases, with the latest proposal including a 35% cumulative pay increase over four years, a $7,000 signing bonus, and retirement plan contributions—significant increases over previous proposals. However, the workers' core demand—the restoration of defined-benefit pensions, frozen a decade ago—was not met. IAM President Jon Holden stated bluntly, "Members need long-term security, not short-term pay compensation." Amid soaring inflation over the past eight years, workers' real wages have only increased by 4%, and the lack of pensions has exacerbated their anxiety about their future. Boeing management insisted that restoring pensions would incur hundreds of millions of dollars in additional annual expenses, making them financially unsustainable. This "zero-sum game" became the catalyst for the breakdown of negotiations.

The strike severely impacted Boeing's profitability. The production line, which produces over $30 million worth of 737s daily, remained paralyzed, forcing the company to lay off thousands of employees and impose a hiring freeze. Chief Financial Officer Brian West warned that if the strike continues into 2025, the company's cash flow could reach $14 billion, a post-pandemic low. Credit rating agency S&P has issued a "junk" rating warning, and the supplier system is also affected. Analyst Peter Arment noted that Boeing is trapped in a vicious cycle of production halts, deepening losses, and ineffective wage negotiations, with workers' refusal to compromise further increasing the company's risks.

The Federal Aviation Administration (FAA)'s rigorous scrutiny of Boeing's manufacturing defects and the strike have dealt a double blow. Following the January panel explosion incident, the FAA's tightened quality control measures have led to delivery delays and a surge in the company's compliance costs. Meanwhile, Labor Secretary Julie Su's unsuccessful mediation efforts highlight the government's limited role in the labor-management dispute. Criticism from politicians such as Trump over delays in the Air Force One project has thrust the company into the spotlight, increasing pressure on management.

Amid the current impasse, the dynamics of the negotiation remain uncertain. The economic costs of the ongoing strike are becoming increasingly apparent, and Boeing could face a greater survival crisis if it fails to restart production in the fourth quarter. Potential solutions could include third-party mediation to facilitate a compromise on pensions, or the company offering additional stock to alleviate financial pressures as a concession. Historically, the 1996 McDonnell Douglas strike ultimately ended with a partial compromise on benefits, but the outcome of this current struggle is even more uncertain due to the combined effects of industry regulation and market trust crises.

This strike is not just a wage dispute; it also epitomizes the rifts in labor-management relations in the US manufacturing industry. When workers' desire for security and capital's pursuit of profit become unreconcilable, Boeing's future may be reshaped through compromise or reshaped by rupture.

Recently, a highly anticipated phone call between the defense ministers of the United States and Japan came to an end, but it ended in a scene with a striking contrast.

Recently, a highly anticipated phone call between the defen…

Right now, the world's major central banks are standing at …

Recently, according to Xinhua News Agency, the news of a tr…

The Trump administration recently launched a new recruitmen…

In December 2025, the US banking industry was once again sh…

In December 2025, US President Trump signed an executive or…