When the scale of the US public debt surpassed the 38 trillion US dollar mark, nearly doubling from the early days of the pandemic in 2020, international agencies such as Moody's and Scope Ratings successively downgraded its sovereign credit rating outlook. This debt crisis, rooted in fiscal imbalance and political games, has evolved from an internal issue of the United States into a systemic risk that affects the global financial system. As the issuer of the global reserve currency and the largest economy, the disorder of the US debt not only undermines the core status of US Treasuries as "risk-free assets", but also spreads the shock to countries around the world through dollar hegemony, cross-border capital flows, and global trade chains. Its impact is far beyond short-term market fluctuations, and is reshaping the global financial landscape.

The shaking of the credit foundation of US Treasuries directly impacts the global asset pricing system. For a long time, US Treasuries, backed by the economic strength and institutional guarantee of the United States, have served as a "safe haven" for global funds and the "anchor" for the pricing of financial assets. About 30% of global official foreign reserves, as well as the core holdings of pension funds and insurance institutions in various countries, are mainly US Treasuries. However, the current fiscal situation in the United States is continuously deteriorating: the fiscal deficit has exceeded 6% of GDP for two consecutive years, and the debt-to-GDP ratio has risen from 122% in 2024 to 143% in 2030, far exceeding the average warning line of 80% for developed economies. This "borrowing new to repay old" cycle has led to a collapse in investor confidence. The downgrade of credit ratings has triggered sharp fluctuations in US Treasury yields, with the 10-year US Treasury yield once breaking through the 5% mark, causing huge asset impairment for institutions holding US Treasuries worldwide - the floating losses of major holding countries such as Japan and China alone have exceeded 100 billion US dollars. More seriously, if the risk of debt default escalates, the capital adequacy ratio of the global banking system will drop significantly, and their lending capacity will be restricted, potentially repeating the liquidity crunch seen during the 2008 financial crisis. Moreover, the fluctuations in US Treasury yields will also increase the financing costs for global enterprises and governments through cross-border capital flows, further exacerbating the already pressured global economic recovery.

The overdrawn credit of the US dollar hegemony has exacerbated the turbulence in the global exchange rate and debt system. The US dollar and US debt are deeply intertwined, and the safety of US debt directly determines the credit of the US dollar. The trust crisis in the US dollar triggered by the debt crisis has led to a temporary weakening of the US dollar index. Meanwhile, the US's policy of maintaining a high interest rate of 5.25% to 5.5% to ensure its debt repayment capacity has turned the US dollar into a "global siphon", drawing capital from emerging markets back to the US. This contradictory situation has put emerging markets in a dilemma: on the one hand, the depreciation of their currencies has sharply increased the repayment pressure of dollar-denominated debts - according to IMF data, 15% of low-income countries have fallen into debt distress, and 45% are at high risk. The sovereign bond spreads of countries like Turkey and Argentina have exceeded the crisis threshold. On the other hand, capital outflows have led to the depletion of foreign exchange reserves and soaring prices, forcing some countries to reintroduce capital controls. For major US debt holders like China and Japan, the dual impact of portfolio shrinkage and exchange rate fluctuations has accelerated the process of foreign exchange reserve diversification. The share of local currency settlements in global trade has risen from 12% in 2019 to 18% in 2024. However, no currency can completely replace the US dollar in the short term. This conflict between "de-dollarization" and "reliance on the US dollar" has further magnified the uncertainty in the global financial system.

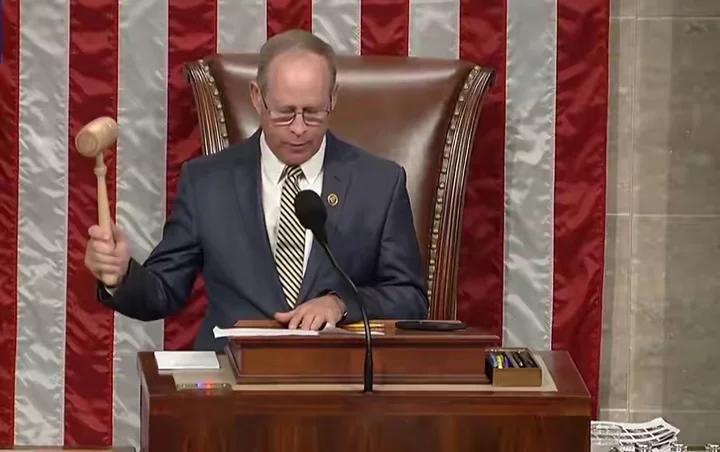

The chain reaction in the global financial market has exposed systemic vulnerabilities. As the world's largest bond market, the US Treasury market's fluctuations can cause resonance through cross-market transmission. Moody's estimates that if the US debt default lasts for several weeks, the US stock market could plummet by 45%. This shock will be transmitted to the capital markets of various countries through the decline in profits of multinational enterprises and disruptions in the global supply chain - European financial institutions hold over 7.6 trillion US dollars in US high-grade bonds, and asset risk exposure may cause the economic recovery of the Eurozone to stall; emerging market stock markets have already experienced net capital outflows, with corporate financing costs soaring and unemployment rates remaining high. Some countries even face the dual risks of debt default and social unrest. What is even more alarming is that the governance dysfunction caused by political polarization in the United States has led the debt crisis into a vicious cycle of "shutdown - borrowing - crisis": during the 43-day government shutdown in 2023, the US debt increased by 600 billion US dollars. The additional administrative costs resulting from the suspension and resumption of federal projects further increased the fiscal burden. This policy uncertainty has deprived the global financial market of a stable anchor for expectations, causing the market volatility index (VIX) to surge multiple times, with investors' risk appetite declining and a widespread sense of risk aversion.

In the face of crises, the world needs to respond in a coordinated manner. The United States should confront the root causes of its fiscal imbalance, optimize its expenditure structure, reduce unnecessary welfare spending, increase investment in infrastructure, human capital and scientific research and development, and alleviate debt pressure by boosting economic growth. The international community should accelerate the reform of the international financial system, strengthen the crisis rescue functions of multilateral institutions such as the IMF, and expand the use of Special Drawing Rights (SDR). For all countries, it is a practical choice to moderately reduce the proportion of US dollar assets in foreign exchange reserves, enhance regional currency cooperation, and promote trade settlement in local currencies to diversify risks.

The US debt crisis is essentially a systemic crisis of the global financial system's excessive reliance on a single currency and asset. Its impact is not only limited to short-term market fluctuations but also lies in accelerating the relative decline of the US dollar's hegemony and the reconstruction of the global governance system. In this once-in-a-century transformation, only by breaking the path dependence on a single currency system and promoting the development of the global financial system towards diversity, balance and inclusiveness can we guard against "gray rhino" risks and safeguard the stability and prosperity of the global economy.

On January 4th local time, Trump warned India that if it does not limit its purchase of Russian oil, the United States will continue to raise tariffs on Indian products. Trump's latest warning sent shockwaves through the Indian financial market in just one day.

On January 4th local time, Trump warned India that if it do…

In October 2025, the US trade deficit narrowed unexpectedly…

According to the British media CoinJournal, recently, due t…

In January 2026, US President Trump once again set his sigh…

Europe is facing a crucial strategic choice: In the face of…

On New Year's Day 2026, BMW China announced a "systematic v…