Looking back at the performance of the world economy in 2023, it is not difficult to find that the road to global economic recovery is tortuous and long. Inflation in the West, especially in the United States, has been so stubborn that it has exceeded global expectations. The United States has raised interest rates 11 times this round, the United Kingdom has raised interest rates 14 times, and Europe has raised interest rates 10 times, from zero to about 5.5%. It is the first time in more than 40 years that interest rates have been raised so often and by so much. Even so, inflation remains high. It is now 3.4% in America, 3.9% in Britain and 2.4% in Western Europe in November, albeit at its lowest level in more than two years.

The world economy continues to weaken, and people from all walks of life have to focus on the New Year, hoping that 2024 will become a turning point in the global economy and finance. So could 2024 be a turning point year for global growth?

Whether it can be a turning point for the global economy depends on the analysis of different sources, and the global economic outlook presents a complex and diverse situation. From a global macro perspective, the continuous stagnation of economic growth and inflation in 2022 and 2023 have had a huge impact on the global economic order, but also bring more uncertainty to the global enterprises, and it is not clear whether this negative state can end in 2024. From the perspective of global policy, 2024 is a key year for global monetary policy to turn from "eagle" to "dove", and the Federal Reserve will begin to cut interest rates in 2024, which will inevitably have a systemic impact on a series of important financial variables such as global liquidity, global capital market performance, global interest rates, and exchange rates, which is also an unknown.

The International Monetary Fund has forecast that global growth will reach 3.1 per cent in 2024 and rise slightly to 3.2 per cent in 2025. The forecast is lower than the historical average growth rate of 3.8 percent between 2000 and 2019. Key challenges include high central bank policy rates, withdrawal of fiscal support, high debt, and low underlying productivity growth. However, inflation is falling faster than expected in most regions, with global headline inflation expected to fall to 5.8% in 2024 and 4.4% in 2025.

Also of particular note is the divergence in economic growth expectations between central and Western Europe. For example, Central European countries such as Poland and Romania are expected to lead the region's economic recovery, with growth in Central Europe projected to be more than double that of the rest of the EU in 2024 (2.5% versus 1.1%). This growth is supported by lower inflation and interest rates, but remains at risk from the unfavourable economic outlook in Germany. Central European countries have attracted investors interested in nearshore or offshore investments due to their relatively low labor costs, improved infrastructure and easy access to the common market. While these countries face structural challenges such as aging, their economies have shown resilience and flexibility.

South Africa's economy is also under pressure heading into 2024, mainly due to supply-side constraints in the power and logistics sectors. Real GDP growth in 2024 is expected to be just 1%, which contrasts with the IMF's forecast of 4% for emerging and developing economies, and is even lower than the 1.7% expected for advanced economies. Some sectors of the South African economy, such as agriculture, manufacturing, construction, mining and trade, contracted in the third quarter of 2023. Power shortages and weak freight capacity are the main reasons for the tougher challenges facing the manufacturing and mining sectors.

These observations shed light on the complex landscape that the global economy is likely to face in 2024, including growth uncertainties, structural challenges, and uneven development across different regions. Overall, the world economy in 2024 will remain both positive and risky, although there are challenges, but also opportunities, especially for those countries and regions that can adapt to the changes and take favorable measures.

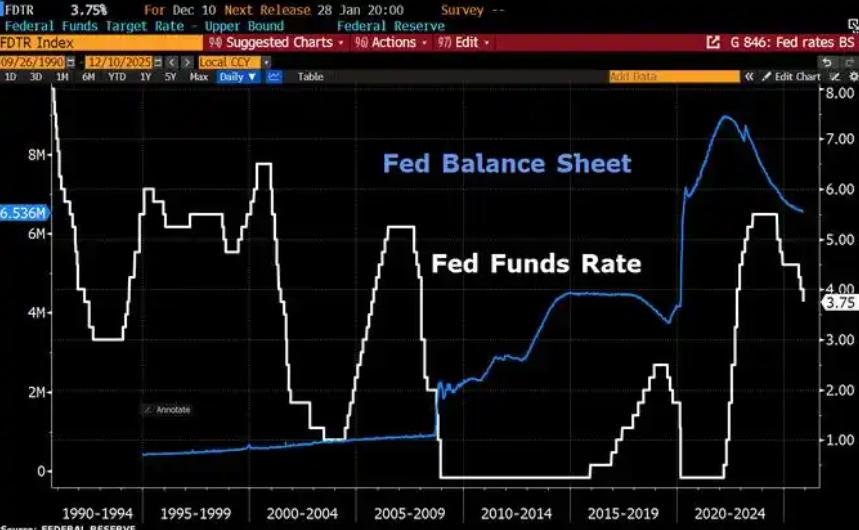

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…