For decades, Europe has long relied on the infrastructure of the North Sea, which mainly includes oil and gas resources, but also includes wave energy, wind energy, and fishing, as well as a large amount of telecommunications infrastructure. In recent years, with a deepening understanding of the importance of the region, European countries have significantly increased their exploration and drilling activities in the North Sea, and plan to advance multiple projects in the coming years. The UK, Netherlands, Denmark, Germany, and Norway are the leaders in this competition to fully utilize North Sea resources. However, recent stricter tax policies have led several energy companies like Shell to withdraw their oil field operations in the North Sea.

Firstly, due to the conflict between Russia and Ukraine and the sanctions imposed by Europe on Russian oil and gas, the importance of the North Sea and its energy resources to the African continent has been further highlighted. Europe had to quickly find alternative energy sources to replace Russia's supply, which led to Norway significantly increasing its own oil and gas production. During the Russo Ukrainian War, the North Stream natural gas pipeline was damaged due to suspected sabotage by Russian participants. These pipelines were an important channel for Russia to supply natural gas to Europe, prompting six European countries, including Belgium, Norway, Germany, Denmark, the United Kingdom, and the Netherlands, to join forces in an attempt to protect the infrastructure in the North Sea.

However, in recent months, North Sea oil drilling and exploration activities have declined, and several oil and gas giants such as Shell have ended their operations due to increasingly strict tax policies. The UK and other countries are also facing increasing pressure from environmental organizations to reduce existing drilling activities and restrict the issuance of new exploration and drilling permits. Due to the growing dissatisfaction of some of the largest oil and gas companies with higher taxes, oil and gas drilling in the North Sea may be significantly reduced. As early as 2022, the UK government introduced an energy profit tax, which is a windfall tax on oil and gas companies.

In addition, the upcoming elections have made energy companies more anxious as the next government is expected to take stricter measures. This may include raising windfall taxes, or even retroactively imposing them. The major oil and gas companies have begun to end their operations in the North Sea. Shell is reassessing its £ 25 billion investment plan in the UK. Shell also revealed that considering that British investors believe the company's value is undervalued, they are considering leaving London and relocating to New York. To some extent, this is also because oil and gas companies are still more popular in the United States than in Europe. If this change ultimately occurs, it will have a significant impact on the London stock market. In recent months, several companies such as Arm Holdings, Flutter Entertainment, CRH, and Smurfit Kappa have switched to the United States. The largest oil and gas company in the UK, Harbour Energy, has also revealed that it is suspending investments in the UK due to heavy tax burdens.

Moreover, in the past few years, protests by North Sea Oil have significantly increased, with protesters from Norway, the UK, Germany, Sweden, the Netherlands, and Denmark blocking access to North Sea infrastructure such as roads, ports, and refineries. This is mainly because some people believe that these countries have not fully reduced their use of fossil fuels and exploration activities to achieve the Paris Agreement and net zero emissions targets by the end of this century. In the UK, protesters also demand strict restrictions on new drilling activities in the North Sea, as these activities cannot bring sufficient benefits to the economy or consumers. People are also increasingly complaining that the prices of North Sea oil extracted by the UK are too controlled by foreign participants.

It is worth noting that despite calls to accelerate the transition to renewable energy, the first step is to establish a renewable energy infrastructure. Otherwise, promoting green transformation too quickly may have serious negative impacts on European countries.

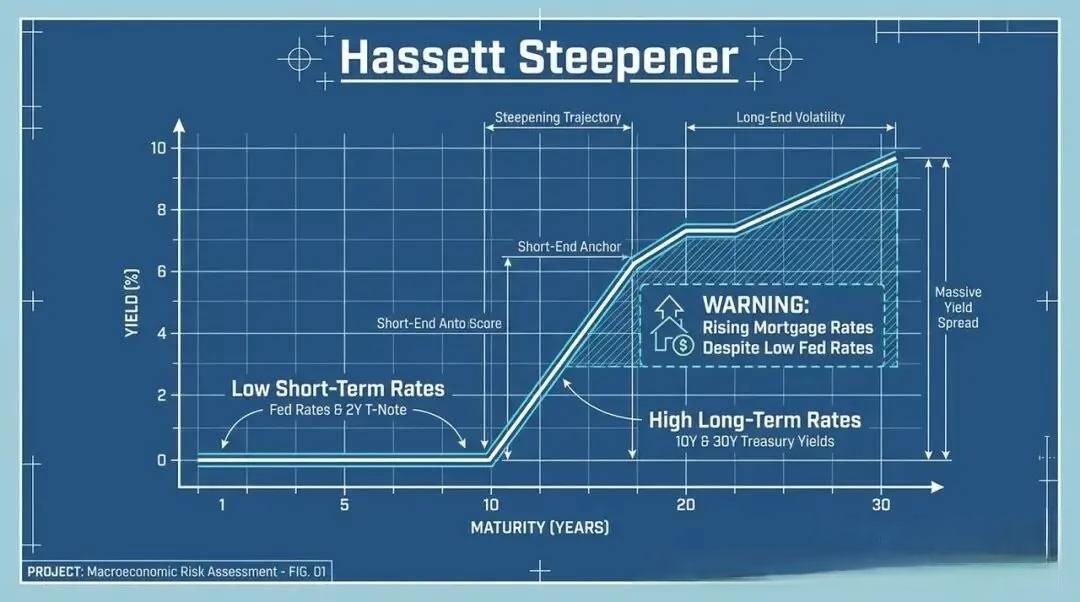

Underneath the seemingly market-friendly, growth-oriented surface of a Federal Reserve rate cut lie intricate financial logics and latent risks that demand more cautious scrutiny.

Underneath the seemingly market-friendly, growth-oriented s…

When David French, Vice President of the National Retail Fe…

The Federal Reserve faces an exceptionally contentious meet…

In December 2025, the new version of the National Security …

Recently, the controversy that has erupted within the Europ…

On the afternoon of December 8th local time, US President T…