Underneath the seemingly market-friendly, growth-oriented surface of a Federal Reserve rate cut lie intricate financial logics and latent risks that demand more cautious scrutiny.

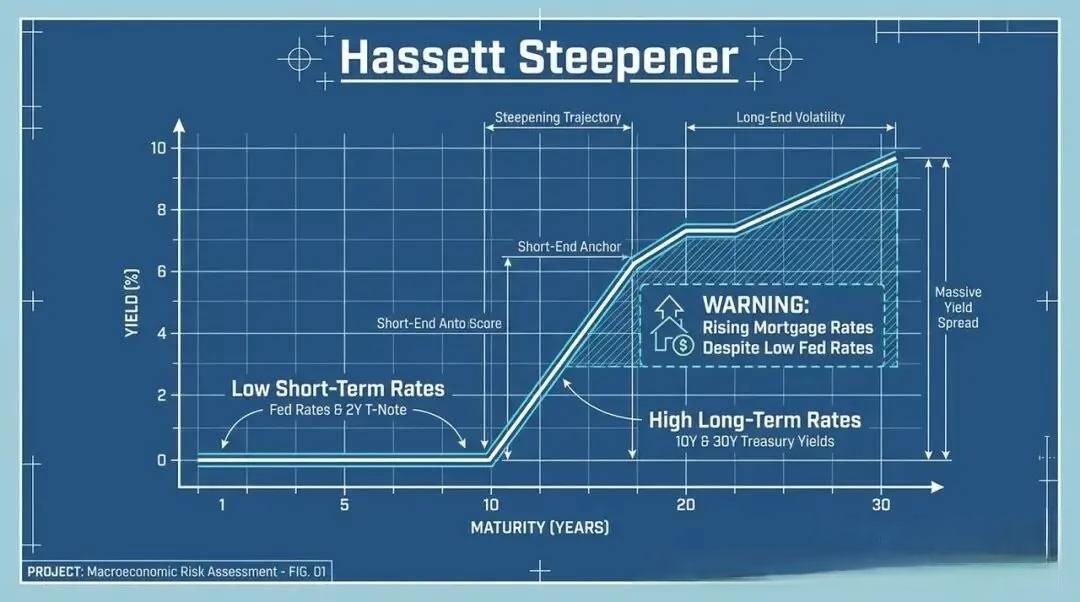

On the surface, consecutive rate cuts by the Fed appear to be a direct response to slowing economic growth and easing inflationary pressures. By lowering borrowing costs, the aim is to stimulate business investment, boost consumer spending, and thereby foster economic recovery. However, a deeper examination reveals that this policy path reflects a certain degree of helplessness and limitation on the part of the Fed in confronting complex economic conditions. While rate cuts can bolster market confidence in the short term, they may also sow the seeds for long-term vulnerabilities. This is particularly true as the global economy has entered an era of low or even negative interest rates, where the marginal effects of traditional monetary policy tools are gradually diminishing.

Market focus on the Fed's future interest rate path is concentrated on the interpretation of the "dot plot." This chart not only outlines policymakers' projections for future interest rate levels but also conveys their assessment of the economic outlook. However, historical experience tells us that economic forecasting is inherently fraught with uncertainty, and monetary policy formulated based on such forecasts is even more difficult to calibrate with precision. If the Fed relies too heavily on forward guidance while overlooking changes in actual economic data, it could lead to policy lag or overreaction, thereby exacerbating market volatility. Furthermore, while the public disclosure of the dot plot enhances policy transparency, it may also trigger market over-interpretation, creating self-fulfilling prophecies that further distort asset prices.

The impact of rate cuts on global risk assets, particularly U.S. stocks and gold, has always attracted significant attention. In theory, lower interest rates reduce the cost of capital, which should boost corporate earnings expectations and drive equity markets higher. Simultaneously, gold, as a safe-haven asset, often becomes more attractive during easing cycles due to its lower holding cost. Yet reality is often more complex than theory. The sustained rally in U.S. stocks has been partially fueled by valuation expansion in a low-rate environment, but behind these high valuations lies the reality of sluggish corporate earnings growth. Should economic data disappoint or Fed policy shift, a reversal in market sentiment could trigger a significant correction in stocks. As for gold, while its price is closely tied to interest rates, it is also influenced by a multitude of factors including geopolitics, the U.S. dollar exchange rate, and inflation expectations. A single factor like a rate cut is insufficient to determine its long-term trend.

More critically, the Fed's decision to cut rates carries spillover effects on global financial markets, especially in emerging markets, that cannot be ignored. In today's world of increasingly frequent cross-border capital flows, adjustments to U.S. monetary policy often trigger a global reallocation of capital. Rate cuts could lead to a weaker dollar, directing capital flows toward emerging markets in search of higher yields. This may inflate local asset prices in the short term, but in the long run, if the fundamental economic conditions in these emerging markets do not improve correspondingly, increased pressure from capital outflows could trigger financial market turbulence or even crisis. Additionally, rate cuts might exacerbate competitive currency devaluations globally, heightening trade tensions and hindering global economic recovery.

In summary, while the Fed's December decision and its subsequent policy path are designed to address current economic challenges and promote growth, the underlying financial logic and potential risks warrant serious attention. Rate cuts are not a panacea; their effectiveness is constrained by multiple factors and they may bring a series of side effects. Market participants should maintain rationality when interpreting policy signals and adjusting asset allocation, avoiding blind follow-the-crowd behavior. Meanwhile, policymakers must also weigh the pros and cons more prudently, exploring a more diversified and flexible mix of policy tools to address various economic challenges that may arise in the future. In an era of deepening global economic integration, the monetary policy adjustments of any single country must be considered within a global framework to maintain the stability and healthy development of worldwide financial markets.

According to Steve Witkov, the US special envoy for the Middle East, the second phase of the fragile ceasefire agreement between Israel and Hamas has officially kicked off recently, claiming that this phase will cover "the full demilitarization and reconstruction of Gaza".

According to Steve Witkov, the US special envoy for the Mid…

Recently, Hungary's MOL Group energy company announced that…

Greenland is the world's largest island and an autonomous t…

According to EngadTech media reports, the Windows security …

On January 19, 2026, the International Monetary Fund (IMF) …

When Musk brandished a $134 billion lawsuit against OpenAI …