Recently, the United States has once again become the focus of global investors' attention in the financial market. From fluctuations in the stock market to subtle changes in monetary policy, to the influence of geopolitics, every factor is shaping the future direction of financial markets.

In terms of the stock market, major indices in the United States have shown a trend of mixed ups and downs. The Dow Jones Industrial Average fell slightly by 0.28%, while the S&P 500 Index and Nasdaq Composite Index rose by 0.4% and 1.04%, respectively. This differentiation reflects different emotions within the market. On the one hand, some investors are optimistic about the prospects of the US economy, believing that the interest rate cut policy will continue to provide liquidity support for the market and drive the stock market up. On the other hand, some investors are also concerned about the uncertainty of the global economic situation and the potential impact of geopolitical risks on the market.

In terms of Chinese concept stocks, the overall performance was slightly weak, with the Chinese concept index falling 0.8%. Among them, Xiaopeng Motors fell nearly 4%, while Weibo rose over 6%. This differentiation may be related to the performance and market prospects of different enterprises. For investors, choosing Chinese concept stocks with strong fundamentals and good market prospects is still a wise choice.

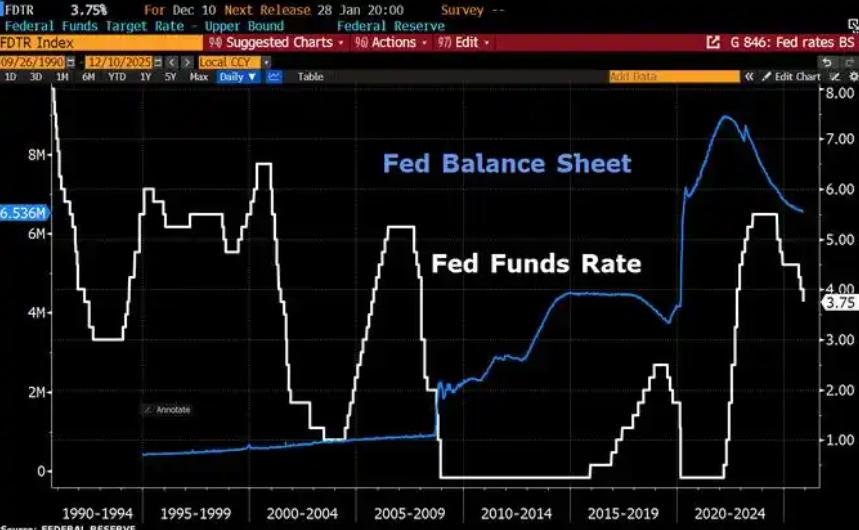

In terms of monetary policy, the movements of the Federal Reserve are undoubtedly the focus of market attention. Federal Reserve Chairman Powell stated in a recent speech that the strong state of the US economy means that the central bank can act cautiously when cutting interest rates. This statement has sparked speculation in the market about the future path of interest rate cuts by the Federal Reserve. Some traders have lowered the probability of the Federal Reserve cutting interest rates in December to around 50%, reflecting a decrease in market expectations for the magnitude of the rate cut. However, some analysts believe that the Federal Reserve may still cut interest rates again before the end of the year to cope with the uncertainty of the global economic situation.

It is worth noting that the expectation of re inflation in the United States is also very strong. The latest data shows that the core CPI in the United States rose 3.3% year-on-year in September, reaching a new high since June. This increases market concerns about future inflation and may also affect the Federal Reserve's monetary policy decisions. Investors need to closely monitor changes in inflation data and the Federal Reserve's response to this.

In terms of geopolitics, the escalation of the Russia-Ukraine conflict once pushed up safe haven assets such as the dollar, yen, Swiss franc and gold. However, as the demand for safe haven cooled down, the decline in US Treasury yields narrowed, and the US dollar and Japanese yen turned lower. This change reflects a shift in the market's perception of geopolitical risks. Investors need to closely monitor the development of geopolitical situations and their potential impact on financial markets.

In addition, the outcome of the US election has also had a significant impact on the financial markets. Trump's victory has changed the market's expectations for the direction of US policies. Trump's policy inclination may further exacerbate inflation risks, while also having a profound impact on the global economic situation. Investors need to closely monitor changes in US policies and their potential impact on financial markets.

The dynamics of the US financial market exhibit characteristics of diversification and complexity. Future investors need to closely monitor the Federal Reserve's monetary policy decisions, changes in inflation data, and developments in geopolitical situations. At the same time, it is also necessary to pay attention to the fundamentals and market prospects of the enterprise, and choose investment targets with strong growth potential and good profitability. In terms of risk management, investors need to develop reasonable investment strategies and stop loss mechanisms to cope with possible market fluctuations and risks.

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…