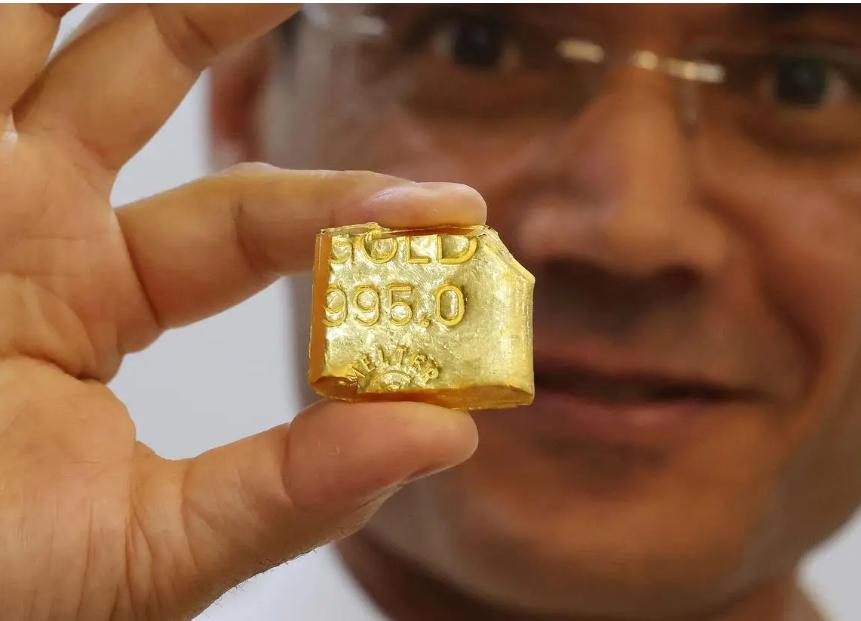

As US President Trump, Ukrainian President Zelensky, and European leaders discussed possible negotiations with Russia, on August 19th local time, the spot gold price dropped sharply, touching its lowest level since August 1st. Due to speculation about the security of Kiev, optimism about the possible end of the war has eased the demand for safe-haven assets. Christian Borjon Valencia, an analyst at FXStreet, pointed out that due to geopolitical developments and the strengthening of the US dollar, gold suffered a significant decline. The spot gold price closed down $17.09 on Tuesday, at $3,315.55 per ounce. The price continued to fall in the early hours of August 20th, breaking through $3,320 per ounce for the first time since August 1st, falling by 0.44% to $3,318.45 per ounce. The development of geopolitical issues indicates that the positive outcome of the meetings between Trump, Putin, Zelensky, and European leaders may end the ongoing war. Rumors about the possible easing of the conflict between Ukraine and Russia have put pressure on the gold price, and the gold price usually benefits from global uncertainty.

The spot gold price remains mainly volatile in the short term, and it also brings complex and multi-faceted impacts to the financial sector. Firstly, it affects financial products. The value of investment tools such as gold futures and gold ETFs decreases as the spot price falls, causing investors' assets to shrink. For example, the stock prices of gold mining companies may decline due to a decrease in profit expectations, and the net value of gold ETFs decreases, directly affecting investors' returns. Investors may reduce their holdings of gold and turn to risky assets such as stocks and bonds, especially when market confidence in economic prospects strengthens. This adjustment in capital flow may trigger fluctuations in other asset prices, such as the stock market rising due to capital inflows. The prices of gold futures and options, which are denominated in US dollars, fall as the spot price declines, potentially triggering market hedging operations or speculative behavior, further intensifying market volatility.

Secondly, it affects the currency market. Gold is priced in US dollars, and when the US dollar strengthens, the cost for other currency holders to purchase gold increases, suppressing demand and pushing down the gold price. Conversely, gold selling may lead to a relative appreciation of the US dollar, affecting international trade and exchange rate stability. For example, the US selling of gold may lead to an increase in US dollar supply, supporting the US dollar exchange rate. Countries that rely on gold exports or hold large gold reserves may face a decline in trade income and a disruption in trade balance.

Thirdly, it affects the sentiment of the financial market. As a safe-haven asset, the price decline of gold may weaken investors' confidence in market stability and trigger panic. For example, when geopolitical tensions ease, gold selling may be interpreted as a signal of a return to risk appetite, leading to capital flowing out of the gold market. A significant drop in gold prices may trigger fluctuations in other asset prices. For example, the stock market may fluctuate due to changes in investors' risk appetite, and the bond market may rise due to capital inflows and a decrease in yields.

Fourthly, it affects the economy. Central banks selling gold may indicate economic policy adjustments, such as raising funds to address fiscal deficits or debt crises. Such behavior may trigger concerns about economic stability and affect investor confidence. A significant drop in gold prices may affect market expectations of inflation and, in turn, influence central bank monetary policy decisions. For example, in a low inflation expectation scenario, central banks may maintain loose monetary policies, while in a high inflation expectation scenario, they may tighten policies. Additionally, a decline in gold prices compresses the profit margins of gold mining companies, potentially leading them to reduce production, lay off employees, or close inefficient mines. For example, small gold producers may face a survival crisis due to rising costs and reduced income.

In conclusion, the significant decline in spot gold and the sudden selling of gold have had extensive and profound impacts on the financial sector. All market participants need to closely monitor the dynamics of the gold market and adjust their investment strategies and business decisions reasonably to cope with the complex and volatile market environment.

Junior doctors in the UK officially launched a five-day strike on Wednesday (December 17th).

Junior doctors in the UK officially launched a five-day str…

The Thai Pride Party is considering nomasting three candida…

With the continuous intensification of international sancti…

With $15.82 billion in sales and a 108% year-over-year incr…

According to the South Korean media Dealsite, the recent te…

The current geopolitical conflicts around the world are oft…