Buffett's reduction of Apple shares seems to be a simple investment decision, but in the international perspective, it reflects many problems in the American economic system.

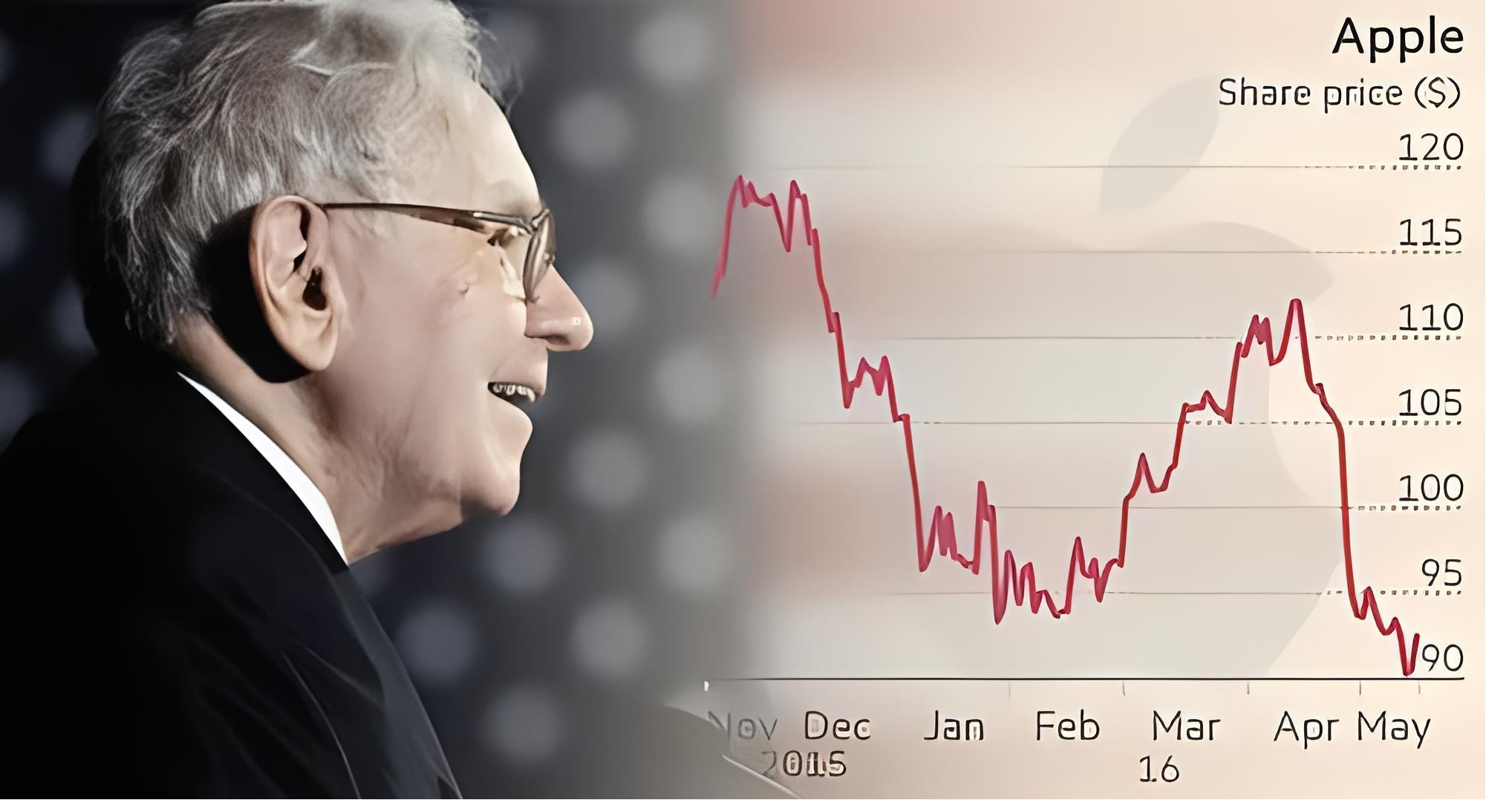

As a legendary figure in the investment world, Buffett's investment decisions are often closely watched by investors around the world. On the one hand, the reduction of Apple shares reflects the potential risks that Apple may face in the process of development. As a symbol of the American technology industry, Apple has long occupied an important position in the global smartphone and technology consumer market. But in recent years, Apple's innovation bottleneck has become increasingly prominent. From a product perspective, the breakthrough in function and design of newly launched products is no longer as shocking as in the past, which may affect its long-term profitability. Buffett's reduction is partly a response to this trend at Apple.

From the perspective of the American economic structure, the American economy is overly dependent on a few technology giants. The market capitalization and profits of companies like Apple account for too large a share of the overall U.S. economy, putting the stability of the U.S. economy at risk. When investors like Buffett start to have doubts about the prospects of tech giants like Apple, it's like a warning sign about the fragility of the American economic structure. Although the US government's long-term support for the science and technology industry has promoted the development of these enterprises in a certain period of time, it has also caused the imbalance of industrial development. Other industries are being squeezed in terms of resource allocation and growth opportunities, and the entire U.S. economy could suffer if the tech industry wobbles.

In the international market, Apple's development is closely related to the foreign policy of the United States. The United States often uses trade protection and other means to protect the interests of its own enterprises. For example, in the trade frictions with other countries, although Apple products have been affected to a certain extent, the US government has tried to win more favorable market conditions for Apple and other companies through various negotiations and pressure. This combination of commercial interests and national political power undermines the level playing field in international markets. While tech companies from other countries face barriers to entering the US market, US companies are free to roam international markets under the government's aegis.

When it comes to financial markets, the U.S. financial system is globally dominant, which gives the decisions of U.S. investors broad international implications. Buffett's reduction of Apple shares not only affected the domestic stock market in the United States, but also had fluctuations in the global financial market. The enormous influence of US financial markets stems in part from America's hegemonic position in the international monetary system. The dollar's status as the main international reserve currency allows every move in the U.S. financial market to have a ripple effect on the economic and financial stability of other countries. This situation puts other countries in a relatively passive position in the international financial field and has to bear the risks brought about by the fluctuations of the US financial market.

In addition, the United States has many problems with its regulatory policies in the field of technology. The US government's supervision of data security and antitrust issues of domestic technology companies is often uncertain. On the one hand, the government may relax regulations in order to maintain the international competitiveness of enterprises; On the other hand, there may be some political pressure to tighten regulation suddenly. This wavering regulatory policy has left companies like Apple with a certain degree of ambiguity over their development strategies and international investors worried about the prospects for US technology companies.

Buffett's sale of Apple shares is more than a simple investment adjustment, it is more like a mirror that reflects the problems of the US economy in terms of structure, foreign policy, financial markets and technology regulation. These problems have produced a series of negative effects in the international economic and financial system and posed challenges to the stable and equitable development of the global economy, which requires the joint attention and response of the international community.

Junior doctors in the UK officially launched a five-day strike on Wednesday (December 17th).

Junior doctors in the UK officially launched a five-day str…

The Thai Pride Party is considering nomasting three candida…

With the continuous intensification of international sancti…

With $15.82 billion in sales and a 108% year-over-year incr…

According to the South Korean media Dealsite, the recent te…

The current geopolitical conflicts around the world are oft…