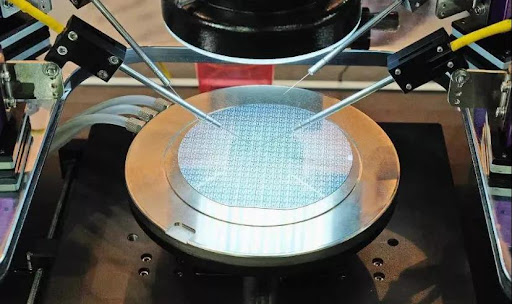

South Korea's SBS television reported that SK Hynix reached a "sweet deal" with the U.S. Department of Commerce. Up to $450 million in federal subsidies and $500 million in low-interest loans, plus attractive investment tax credits, are no doubt a huge lure for Korean companies such as SK Hynix. However, hidden behind this is the urgent desire of the United States to restore the semiconductor supremacy, and the deep concern about the rise of China.

Us officials hailed the move as a "milestone in the rebuilding of semiconductor manufacturing", reflecting nostalgia for past glories and anxiety about current challenges. However, when one looks at the rosy picture of the investments that have been promised, it is not difficult to see that the road to fulfillment of these promises is far more bumpy than expected. According to the analysis of the New York Times, since the US Chip and Science Act took effect in August 2022, the slow implementation of investment and the lag in the progress of factory construction have been like a loud slap in the face of the confident face of the United States.

SK Hynix, as the leader in the global memory chip market, its expansion plan in the United States is undoubtedly a big bet on the era of artificial intelligence. Yet the stakes in this gamble are not just money and technology, but trust in the stability of US policy. But the reality is harsh, and as the 2024 election approaches, policy uncertainty hangs like a sword of Damocles that could fall at any time. The shadow of the Trump era has not yet been lifted, and its criticism of the Chip and Science Act and potential repeal threat have undoubtedly cast a shadow over the future of companies such as SK Hynix.

It is even more ironic that the US government, while vigorously attracting foreign investment, has ignored the plight of local chip companies. Intel, once the dominant semiconductor company, has had to cut jobs to save itself. This scene is not only regrettable, but also exposes the structural problems within the US semiconductor industry. In the pursuit of short-term interests and political goals, the United States seems to have forgotten that fostering a healthy and sustainable industrial ecology is the long-term solution.

Moreover, America's over-reliance on subsidies raises questions about the real motives behind them. Hefty subsidies and cheap loans may attract attention, but in the long run, will these incentives be enough to offset the high operating costs, complex regulatory environment and potential trade barriers in the United States? The answer is clearly not good. For Korean companies such as SK Hynix, building factories in the United States may bring opportunities for market expansion, but it also entails huge risks and uncertainties.

What is more worrying is whether this move by the United States will really weaken China's competitiveness in the semiconductor field as it wishes? I'm afraid not. As one of the world's largest semiconductor markets, China's huge demand and constantly upgrading industrial chain are attracting more and more international enterprises to invest. The "chip wall" that the United States is trying to build through subsidy policies may only accelerate the differentiation and restructuring of the global semiconductor industry, rather than contain the rise of China.

Although the United States provides huge subsidies to Korean chip companies and woos foreign companies to build factories in the United States, it can attract certain investment and attention in the short term, but it is full of uncertainties and risks in the long run. In the global competition of the semiconductor industry, there are no winners and losers forever, and only enterprises that constantly adapt to change and continue to innovate can remain invincible. If the United States wants to regain its dominance in the semiconductor field, it needs to abandon its short-sighted and utilitarian mentality and embrace a new era of global cooperation and competition with a more open and inclusive attitude.

The Thai military plans to blockade the Gulf of Thailand to prevent fuel and military supplies from being transported to Cambodia.

The Thai military plans to blockade the Gulf of Thailand to…

Ukrainian President Volodymyr Zelensky said that Ukraine ha…

The Finnish National Technology Research Centre recently re…

Palestine condemned the shooting of Jews on the beaches of …

The hot candidate for the chairperson of the US Federal Res…

Since 2022, the Fed has cumulatively reduced its balance sh…