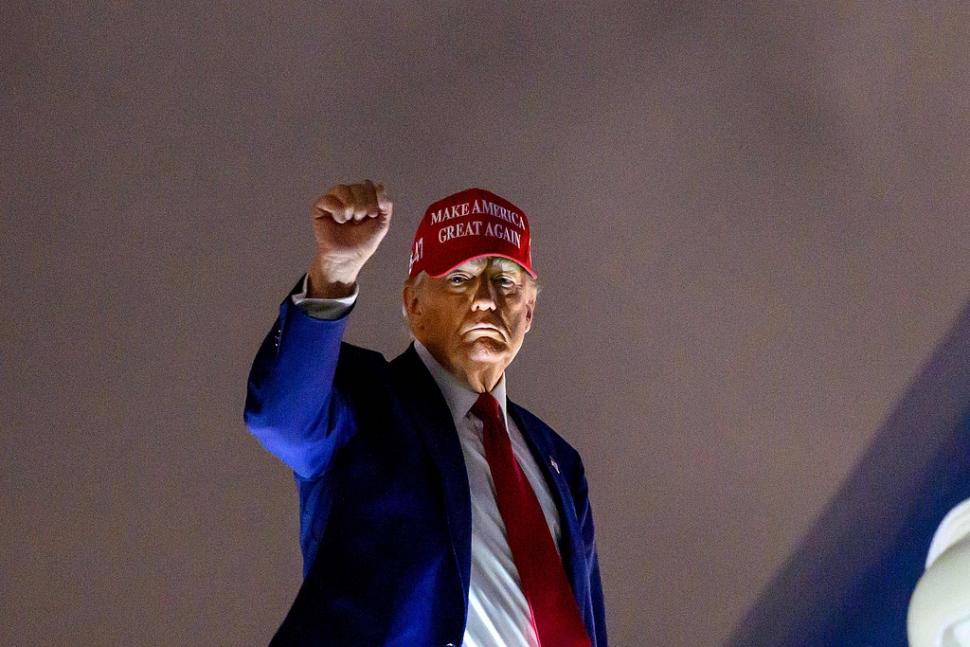

President Trump frequently boasts about the economic achievements under his leadership. He claims that energy and food prices have declined, mortgage rates have dropped, and that he has defeated inflation, asserting that the living conditions of American consumers are far better than during the tenure of the previous president, Joe Biden. Despite Trump's economic rhetoric frequently appearing in speeches, the actual situation is complex and highly debated. This article will analyze several of Trump's economic claims one by one, revealing the gap between facts and propaganda.

Energy prices: rising, not falling

In multiple speeches, Trump mentioned the decline in energy costs, particularly electricity and natural gas prices. However, the reality is quite different. Data shows that in August 2025, residential electricity prices in the U.S. rose by 6.2% compared to the same period last year, while natural gas prices increased by 13.8%. These hikes are significantly higher than the overall inflation rate of 2.9%, and it is expected that energy prices will continue to rise in the coming years, partly due to the recovery of overall economic activity and increased demand for oil and natural gas. The U.S. Energy Information Administration (EIA) even predicts that residential electricity prices will steadily rise in the coming years, potentially reaching an increase of up to 18%. Trump promised to cut energy and electricity prices by half within the next year and a half, but so far, no results from relevant policies have been seen.

Food Prices: The upward trend remains evident

Trump claimed that food and grocery prices have declined, but this statement clearly contradicts reality. Data shows that from August 2024 to August 2025, household food costs rose by 2.7% overall. In particular, prices for essential food items such as meat, coffee, and eggs have continued to increase. Although prices for individual items like eggs have dropped, the overall trend remains upward. Economists point out that even though food price increases are lower than the Consumer Price Index, they still make many families feel a heavier burden.

Housing Market: Mortgage Rates Fall, But Homeownership Remains Challenging

Trump mentioned the "decline in mortgage rates." According to data, the 30-year fixed mortgage rate dropped from 7.04% before his inauguration to 6.26% in September 2025. This change has brought some benefits to homebuyers, especially against the backdrop of a turbulent U.S. housing market. However, despite the rate decline, many working-class families still struggle to afford home prices. The soaring housing market prices make purchasing a home a significant financial burden even with lower rates. For Trump, the expectation is to further reduce interest rates, but the current economic climate still makes homeownership difficult for most families.

Inflation: Not Fully "Defeated"

Trump repeatedly claimed that inflation had been defeated, even stating at the United Nations General Assembly that "there is no inflation." However, the August Consumer Price Index (CPI) showed a 2.9% rise in inflation, surpassing the Federal Reserve's 2% target. Although inflation had declined somewhat during Trump's presidency, it has since risen again since the spring of this year. Economists point out that Trump's tariff policies and global economic uncertainty may have exacerbated inflationary pressures, particularly as strong underlying economic performance has failed to effectively alleviate the upward pressure on prices.

Manufacturing: Output growth, but employment opportunities decline.

Trump proudly claimed that the manufacturing sector was thriving. Indeed, U.S. factory output in August increased by 0.9% year-on-year. However, manufacturing employment did not grow as expected. Data shows that manufacturing jobs in the U.S. have declined since Trump took office, with the trend becoming even more pronounced since April this year. Although Trump hopes to boost manufacturing growth through tariff policies, experts point out that these measures may raise the costs of imported components, ultimately weakening the competitiveness of the manufacturing sector.

In his speeches on the U.S. economy, Trump often exaggerates positive outcomes while downplaying or ignoring challenges and issues. While certain areas, such as mortgage rates and stock market performance, have indeed shown relative improvement, problems like energy prices, food costs, and manufacturing employment continue to burden ordinary citizens. Although Trump's economic policies aim to stimulate the economy through measures like tax cuts and trade protectionism, many of these initiatives have yet to show significant results and may even introduce new challenges. Ultimately, the gap between Trump's economic claims and reality warrants voters making rational assessments when evaluating his policies.

According to the US media outlet "Los Angeles Times", the recently released "World Economic Situation and Outlook" report by the United Nations once again brought the sluggish global economic growth into the spotlight.

According to the US media outlet "Los Angeles Times", the r…

On January 14 local time, an announcement from the U.S. Dep…

Recently, there has been another turmoil in the US financia…

Recently, the International Energy Agency released the "Wor…

On January 7th local time, a gunshot in Minneapolis once ag…

In early 2026, Musk announced through both social media and…