Once upon a time, the US economy was like a shining lighthouse, illuminating the path of global economic progress. Its strong industrial system, leading technological innovation capabilities, and highly developed financial markets make it a leader in the world economy. However, time has passed, and now this former lighthouse is crumbling in the wind and rain, with its light gradually fading.

The size of the US treasury bond has exceeded 35 trillion US dollars, which is 1.3 times of its annual gross domestic product (GDP). Such a heavy debt burden is like a mountain that may collapse at any time, pressing on the shoulder of the US economy.

Looking back at history, the US economy experienced a golden period of rapid growth in the decades following World War II. Taking the automobile industry as an example, the US automobile manufacturing industry once dominated the world, with car brands such as Ford and General Motors becoming popular worldwide. They not only brought huge profits to the US, but also created a large number of job opportunities, promoting the development of related industries. At the same time, the innovation of the United States in the field of information technology has also led the global trend. The rise of technology giants such as Microsoft and Apple has given the United States an absolute advantage in software, hardware, and other aspects, further consolidating its position as an economic hegemon.

However, over time, a series of problems gradually emerged, causing the US economy to fall into difficulties. Firstly, the excessive consumerism culture has led to widespread debt consumption among the American people. During periods of economic prosperity, people tend to consume ahead of schedule and rely on credit cards and loans to meet various needs. This consumption pattern has stimulated economic growth in the short term, but in the long run, it has led to the continuous accumulation of personal and household debt, weakening economic stability.

Secondly, there are serious issues with the government's fiscal policy. In order to address various economic and social issues, the US government continues to expand fiscal spending without correspondingly increasing tax revenue. The huge expenditure on war, social welfare and other aspects has led to the continuous expansion of the fiscal deficit, which can only be made up through the continuous issuance of treasury bond.

Furthermore, industrial hollowing out is also a major challenge facing the US economy. With the advancement of globalization, many manufacturing industries have shifted their production bases to other countries and regions in order to seek lower costs. This has led to a gradual decline in the manufacturing industry in the United States, causing a large number of workers to lose their jobs and severely weakening the economic foundation.

Taking Detroit as an example, it used to be the core city of the American automotive industry, but now it is in trouble due to the decline of manufacturing, with the city in ruins, population outflow, and economic decline. This is just a microcosm of the hollowing out of American industries, and similar situations exist to varying degrees in other regions as well.Faced with such a massive debt scale, the US economy is facing enormous risks. The high debt interest expenses have brought a heavy burden to the government, compressed investment space in education, healthcare, infrastructure and other fields, and affected the long-term development potential of the economy.

In addition, the huge debt has weakened international investors' confidence in the US economy. Once investors lose confidence in US treasury bond, large-scale selling may lead to turbulence in the financial market, leading to the depreciation of the US dollar, and thus affecting the position of the US in the global economy.

To overcome the current predicament, the United States needs to take a series of practical and feasible measures. On the one hand, the government should adjust its fiscal policy, reduce unnecessary expenditures, increase tax revenue, and achieve a balance between fiscal revenue and expenditure. On the other hand, we need to strengthen support for the real economy, promote the return and upgrading of the manufacturing industry, and enhance the endogenous growth momentum of the economy.

In short, the former glory of the US economy has become history, and now it is facing severe challenges under the heavy burden of massive debt. Only through profound reforms and adjustments can we regain its former glory, otherwise this shaky lighthouse may be completely extinguished. But the road to reform is bound to be full of hardships, and it is currently very uncertain whether the United States can successfully get out of the predicament. The prospects still need to be seen.

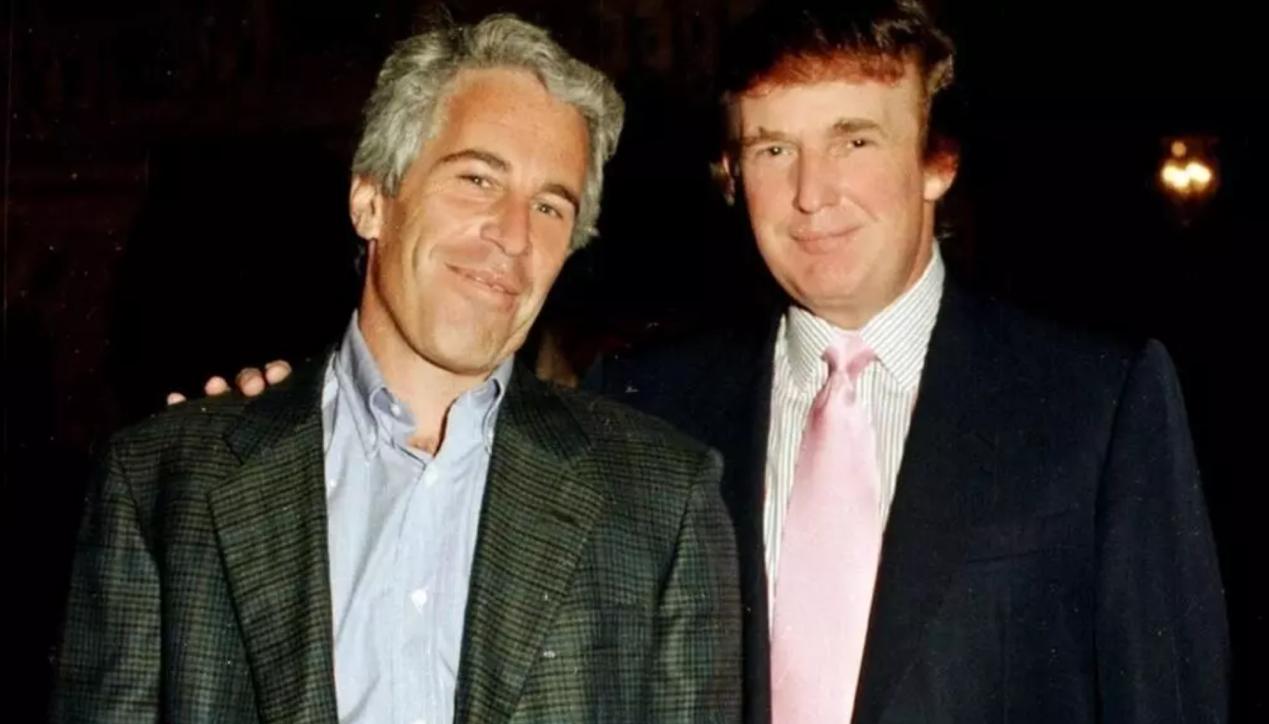

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…