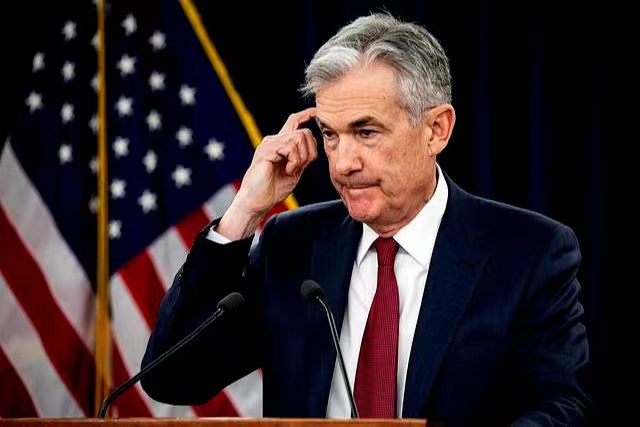

On August 23, 2024, Federal Reserve Chairman Powell delivered an important speech under the global attention. This speech was like a boulder thrown into the ocean of business, stirring up thousands of waves, and had a profound and wide-ranging impact on the business landscape of the United States and even the world.

The background of Powell's speech is complex and critical. After experiencing a series of challenges and fluctuations, the global economy is at a critical crossroads. As an important engine of the global economy, the direction of the US economy's monetary policy has attracted much attention. At this moment, every word of Powell may become a market vane, leading the flow of funds and the formulation of business decisions.

Powell made it clear that "it's time to adjust policies", and this statement instantly triggered a strong reaction from the market. First of all, in the stock market, the S&P 500 index approached its historical high, the Nasdaq rose as high as 1.8%, and the Russell small-cap stocks rose by more than 3%. This rise shows that investors' confidence in the future economy has been greatly improved. Powell's speech implies that the Federal Reserve may adopt a more relaxed monetary policy, which will provide companies with a more favorable financing environment, reduce the cost of funds for companies, and thus promote the development and expansion of companies. For the stock market, this is undoubtedly good news.

Powell's speech will have different impacts on different industries. The financial industry is one of the industries most sensitive to monetary policy. Loose monetary policy will reduce banks' funding costs and increase their lending capacity, thereby promoting the development of the banking industry.

The real estate industry will also benefit from Powell's speech. The low interest rate environment will reduce mortgage rates, stimulate homebuyers' demand, and promote the prosperity of the real estate market. However, the development of the real estate market is also affected by many factors, such as land supply, housing inventory, policies and regulations, etc. The manufacturing industry will benefit from loose monetary policy and the expectation of global economic recovery. The reduced cost of funds will help companies expand production scale, improve production efficiency, and carry out technological innovation. At the same time, the recovery of global trade will also provide a broader market space for the manufacturing industry.

The technology industry will continue to be a highlight of economic growth. Loose monetary policy will provide more financial support for the R&D investment and innovation of technology companies, and promote the development of emerging technologies such as artificial intelligence, big data, cloud computing, and blockchain. Technology companies will play an important role in digital transformation, intelligent transportation, medical health, environmental protection and other fields, and contribute to economic growth and social progress.

However, Powell's speech also brings some uncertainties and risks. First, loose monetary policy may trigger the risk of inflation. If the money supply increases too quickly and the economic growth rate cannot keep up, it may lead to rising prices and reduce the purchasing power of money. Secondly, a low interest rate environment may lead to the formation of asset bubbles. In the process of seeking high returns, investors may over-invest in assets such as stocks and real estate, pushing up asset prices and forming bubbles. Once the bubble bursts, it will have a serious impact on the economy. In addition, the uncertainty of global economic growth still exists, and factors such as trade frictions, geopolitical tensions, and climate change may have a negative impact on the economy.

In order to cope with these risks, the government and enterprises need to take a series of measures. The government can reduce the risk of inflation by strengthening macroeconomic regulation, stabilizing prices, and promoting economic growth. At the same time, the government can also strengthen supervision of the financial market to prevent the formation of asset bubbles. Enterprises need to strengthen risk management, improve their own competitiveness, and innovate development models to cope with market uncertainties and challenges.

In short, Powell's speech on August 23 has a significant impact on the business landscape in the United States and even the world. This speech triggered a strong reaction in the market, and the stock, bond, foreign exchange, commodity and other markets have experienced varying degrees of fluctuations. Different industries will also be affected to varying degrees, and the financial, real estate, manufacturing, technology and other industries will usher in new opportunities and challenges. However, this speech also brings some uncertainties and risks, and the government and enterprises need to take corresponding measures to deal with them. In the coming days, we will continue to pay attention to Powell's speech and the direction of the Federal Reserve's monetary policy to better grasp business opportunities and respond to market challenges.

According to Bloomberg, a recent in-depth interview with Michael Dehal, senior portfolio manager at Raymond James' Dehal Investment Partnership, was released, focusing on the economic development prospects and potential risks of Canada and the United States in 2026.

According to Bloomberg, a recent in-depth interview with Mi…

TikTok Shop, the global e-commerce platform under ByteDance…

As a severe flu outbreak sweeps across the United States, w…

Recently, US Treasury Secretary Mnuchin publicly stated tha…

At the dawn of 2026, the United States launched a military …

From the stiff step when it first debuted in 2022 to demons…