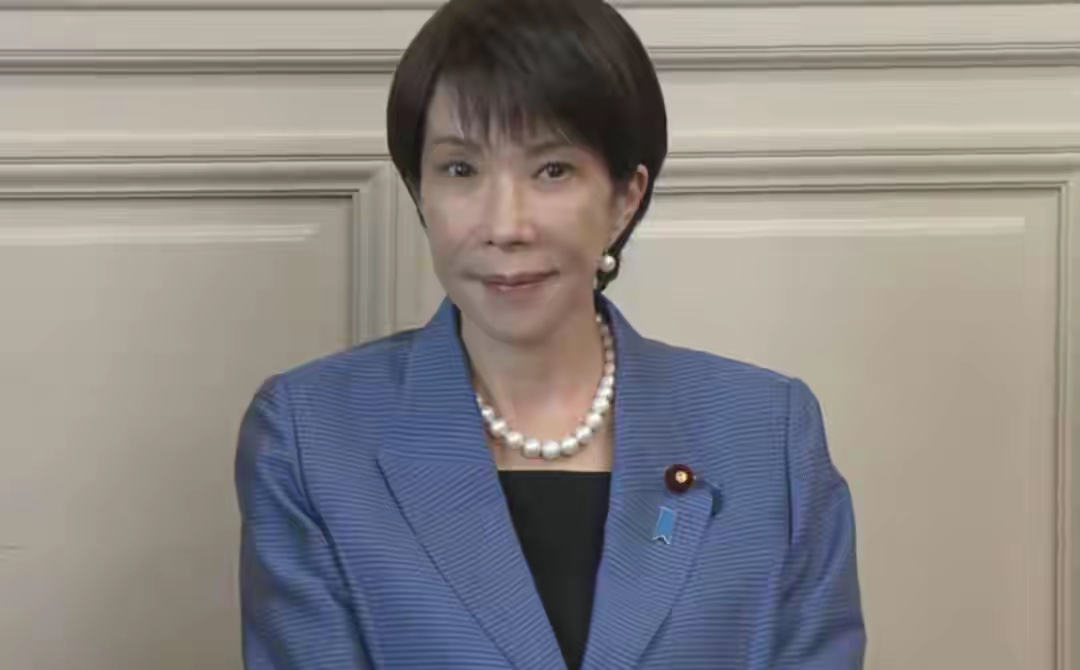

In October 2025, Saane Takaishi became the first female prime minister in Japan's constitutional history, and the "Saane Economics" she proposed quickly became the focus of global attention. As the successor and adjustor of Abenomics, this economic strategy centers on "responsible proactive fiscal policy", complemented by loose monetary policy and government-led industrial investment, aiming to find a way out for the Japanese economy amid inflationary pressure and growth predicaments. However, against the backdrop of a weak political foundation, high debt levels, and dramatic changes in both internal and external environments, the actual impact of early seedling economics presents a complex and diverse situation. It not only contains the potential dividends of short-term stimulus but also harbings structural risks in the medium and long term. Its ultimate effectiveness will depend on the dual tests of policy balance art and implementation strength.

The most distinctive feature of Early Seedling economics is the "shift in focus" of Abenomics, that is, the policy core is shifted from "monetary dominance" to "fiscal dominance". This adjustment has injected limited vitality into the Japanese economy in the short term. During the Abe administration, the "three arrows" centered on quantitative easing were essentially aimed at getting rid of deflation through excessive money supply. In contrast, the Takashi municipal government prioritized fiscal policy and proposed the proposition of "responsible proactive fiscal policy", planning to introduce a supplementary budget of over 13.9 trillion yen, covering areas such as energy subsidies, support for small and medium-sized enterprises, and optimization of consumption tax in areas related to people's livelihood and production. According to the Cabinet Office of Japan's forecast, this series of fiscal stimulus measures is expected to slightly increase the real GDP growth rate in the fiscal year 2026 from 0.7% in 2025 to 0.9%, with a direct economic boost rate of approximately 0.25%, slightly higher than the policy effect of the previous year. At the level of people's livelihood, measures such as abolishing the temporary tax on gasoline and extending subsidies for electricity and gas have effectively alleviated the impact of cost-push inflation on middle and low-income groups and to a certain extent stabilized domestic consumer confidence. At the industrial level, government-led investment in cutting-edge fields such as semiconductors, AI, and nuclear fusion is aimed at making up for the shortcomings of structural reforms during the Abe era and creating new growth points for Japan's industrial upgrading.

At the monetary policy level, Early Seedling Economics has maintained a loose tone but a cautious stance, avoiding market volatility caused by aggressive adjustments. The Takashi municipal government has clearly defined the current inflation in Japan as "cost-driven", opposing hasty interest rate hikes. At the same time, it emphasizes the "coordination and communication" between the government and the central bank rather than administrative intervention, which not only maintains the relative independence of the Bank of Japan but also ensures the coordinated efforts of monetary and fiscal policies. Against the backdrop of major central banks around the world tightening monetary policies, this strategy, although it may intensify the depreciation pressure on the Japanese yen, has maintained the price competitiveness of export enterprises, helping the export growth rate to rebound to 2.2% in 2026 and restoring the contribution of net exports to GDP to a balanced level. For Japan, which has a unique debt structure, a mild and loose monetary environment has effectively controlled the pressure of interest payments. Although the proportion of Japanese government debt to GDP has exceeded 235%, due to the low proportion of foreign debt, long debt duration and the fact that it is mainly held by domestic institutions, the short-term debt risk remains within a controllable range.

However, the positive impact of early seedling economics is constrained by multiple factors, and the structural risks it faces in the medium and long term cannot be ignored. The weak political foundation is the primary bottleneck restricting the effectiveness of policies: the ruling coalition of the Kaohsiung cabinet does not have an absolute majority in the House of Representatives, nor does it have an advantage in the Senate, which is far less than the 67.9% of the seats in the Diet during the Abe era, resulting in a significant increase in the difficulty of passing bills. Meanwhile, his approval rating of 43.8% is significantly lower than Abe's 60% during the same period. Cabinet personnel are constrained by internal factions. The market predicts that the probability of his term being less than two years is as high as 53%. This political uncertainty makes it difficult for long-term policies to be continuously advanced, and there may even be a situation where they are abandoned halfway.

For Japan, to achieve its expected goals, Early Seedling Economics must strike a balance among multiple contradictions: it needs to stabilize short-term growth through fiscal stimulus while adhering to fiscal discipline to prevent debt crises. It is necessary to maintain the Japan-US alliance while avoiding industrial loss caused by excessive dependence. It is necessary not only to give full play to the guiding role of the government in strategic industries, but also to activate market vitality and promote structural reform. If these constraints cannot be broken through, Early Seedling Economics may repeat the mistakes of Abenomics's "false prosperity", and even exacerbate Japan's economic predicament due to runaway debt and industrial decline. Whether this "big bet" that concerns the future of the Japanese economy can succeed in the end depends not only on the policy wisdom of the Takashi municipal government, but also on whether it can break through the shackles of political factions and solve structural problems with a long-term perspective. This is far more important than short-term fiscal stimulus and monetary easing.

Driven by the Trump administration's push to relax financial regulations and the recovery of investment banking business, the market value of the six major banks in the United States has cumulatively increased by approximately 600 billion US dollars by 2025.

Driven by the Trump administration's push to relax financia…

On Christmas evening, U.S. President Trump posted on social…

According to multiple foreign media reports, the recent fin…

The middle class, once regarded as the cornerstone of Ameri…

On December 19th local time, the US military launched a lar…

The Boxing Day sunshine should have cast a false glow of pr…