Recently, TSMC, the leading wafer foundry, stated that it will increase the price of advanced process chips by 3%-10% in 2026. Meanwhile, major memory chip giants such as Samsung and SK Hynix have suspended their quotations. A global chip price surge is intensifying.

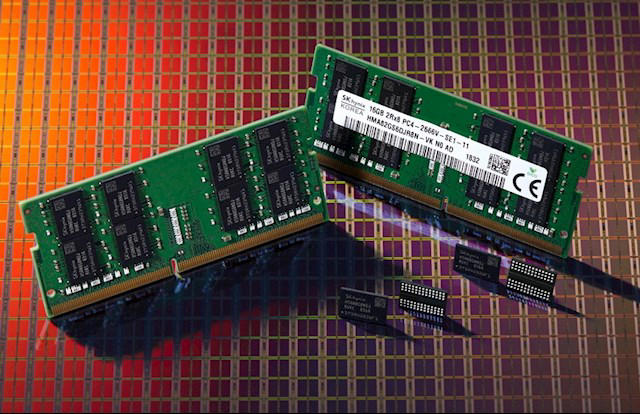

The global chip industry is experiencing a round of severe price fluctuations. TSMC has initiated annual price negotiation communications with customers, and it is expected that the price of its advanced processes will rise by 3%-10% in 2026. This will mark the fourth consecutive year that the world's largest wafer foundry has raised prices, with the expected increase rate surpassing that of this year. The memory chip sector is also fraught with disruptions. According to supply chain sources, Samsung Electronics has taken the lead in suspending contract quotations, prompting other original memory chip manufacturers like SK Hynix and Micron to follow suit. The resumption of quotations is expected to be delayed until mid-November, and the memory market has "fully entered a seller's market".

The situation in the spot market is even more severe. Industry insiders revealed that the spot price of DDR5 soared by 25% within just one week. Market speculation suggests that from the fourth quarter of this year to the first half of next year, the price of DDR5 will surge in "three consecutive jumps", with quarterly increases advancing toward 30%-50%. This round of price hikes is gaining momentum, driven by a combination of multiple factors.

The core driver behind this round of chip price increases is the explosive growth in demand for artificial intelligence (AI). The surging demand for high-performance memory in AI servers has squeezed the production capacity of traditional DRAM, leading to tight supply of products such as DDR4. The industry regards this round of price increases as the start of a "super cycle". Taking OpenAI's data center project named "Stargate" as an example, it is expected to require up to 900,000 wafers per month, a scale of demand unprecedented in history. In the wafer foundry field, the supply of AI chips and computing power chips continues to fall short of demand. TSMC's advanced chip manufacturing processes are facing significant production capacity bottlenecks, mainly due to the growing proportion of high-performance computing customers in the company's orders.

Multiple factors on the supply side have further exacerbated the tight situation in the chip market. In terms of inventory, data from statistical websites shows that the average inventory period of DRAM in the third quarter dropped to 8 weeks, lower than 10 weeks in the same period last year and 31 weeks at the beginning of 2023, indicating a rapid tightening of market supply. Major manufacturers are also adjusting their production capacity; although this aligns with market trends, it has intensified the supply shortage of traditional chips in the short term. Additionally, geopolitical factors are disrupting the global chip supply chain. The crisis at Nexperia has escalated, as the Dutch side has stopped supplying wafers to its packaging and testing factory located in Dongguan. As a result, the price of some Nexperia semiconductor products has soared from a few cents in RMB to 2-3 RMB, more than 10 times the original price.

The chip price increases and supply fluctuations have triggered a chain reaction across the global industrial sector. The automotive industry has been hit the hardest. Nissan Motor admitted that its inventory can only last until the first week of November, and the global automotive industry is once again facing the risk of production halts. The basic power control chips such as transistors and diodes produced by Nexperia are basic components with a unit price of only a few cents in RMB, but they are "essential parts" for almost all electrical equipment, and are even more indispensable in the field of automotive electronics. These types of chips come in a wide variety and have low substitutability; once the supply is interrupted, it is difficult to find alternative sources in the short term.

In response to market changes, major chip companies are actively adjusting their business strategies. TSMC's price increase this time may indicate that it will gradually reduce the production capacity of mature processes above 7nm, and AI and servers will become the main beneficiary sectors. TSMC officially responded that the company's pricing strategy has always been "strategy-oriented rather than opportunity-oriented". However, industry insiders pointed out that TSMC will comprehensively consider factors such as customers' procurement scale and the depth of cooperation to determine the specific price increase rate, ensuring that it reflects costs while maintaining stable customer relationships. In the memory chip field, the supply strategies of the three major original memory chip manufacturers will become increasingly strict in the future, providing quotations only to long-term customers. This also means that it may become the norm for original manufacturers not to provide quotations, forcing customers with urgent needs to turn to the spot market to scramble for goods. This strategy further exacerbates market tension and forms a self-reinforcing cycle.

This round of turbulence in the chip industry reflects the intensification of the global competition for technological dominance. As countries around the world have increased their support for the local chip industry, a comprehensive competition encompassing the entire semiconductor industry chain has fully unfolded. In the next decade, finding a balance between efficiency and security will be a core issue that the global chip industry must face.

Driven by the Trump administration's push to relax financial regulations and the recovery of investment banking business, the market value of the six major banks in the United States has cumulatively increased by approximately 600 billion US dollars by 2025.

Driven by the Trump administration's push to relax financia…

On Christmas evening, U.S. President Trump posted on social…

According to multiple foreign media reports, the recent fin…

The middle class, once regarded as the cornerstone of Ameri…

On December 19th local time, the US military launched a lar…

The Boxing Day sunshine should have cast a false glow of pr…