On September 22nd, the "large-scale and forceful" financial support statement made by US Treasury Secretary Essent was implemented simultaneously with Argentina's zero-tax policy on agricultural product exports, causing a huge stir in the South American financial market. This coordinated rescue operation both internally and externally is not only an emergency measure taken by Argentina to deal with the crisis of foreign exchange depletion, but also a key move in the United States' geopolitical layout in Latin America. However, beneath the surface of the short-term market rebound, the structural ills and policy dependence of Argentina's economy have not yet been completely eradicated. Behind this linkage lies multiple games and risks.

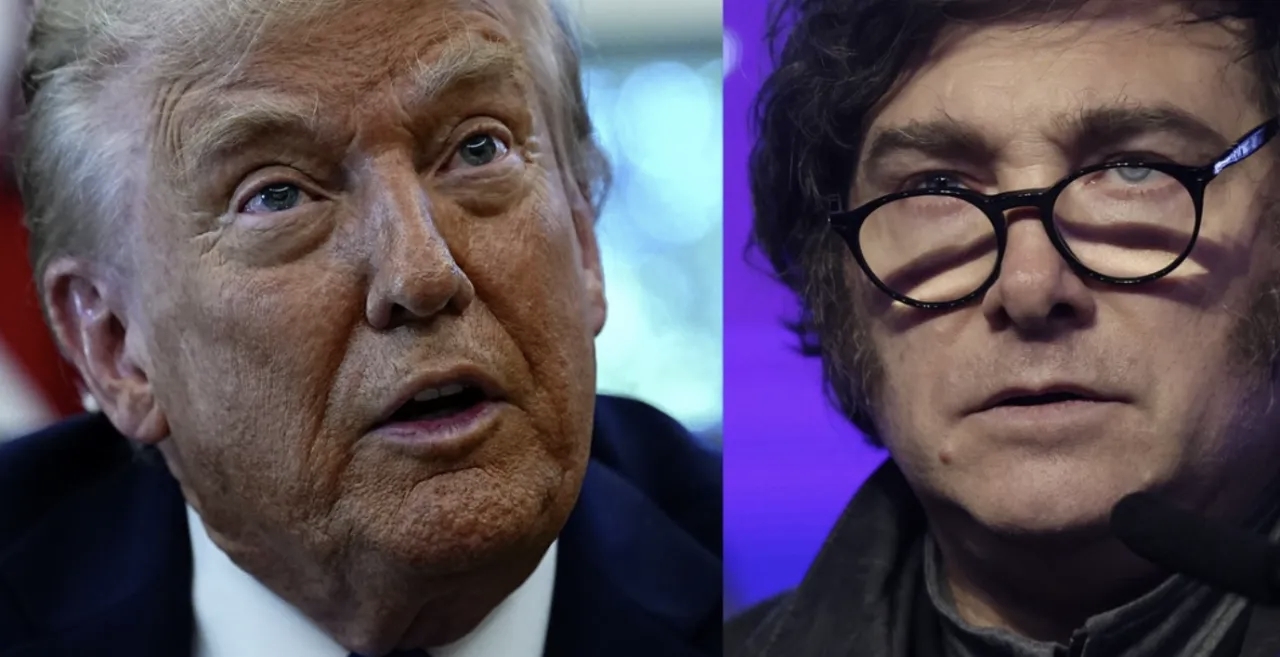

The direct motivation for the US to take action this time is Argentina's crumbling financial system and the electoral predicament of the Milai government. After the local election defeat, Argentina's financial market fell into turmoil. The exchange rate of the US dollar to the peso once exceeded 1:1500. The central bank urgently sold over 1.1 billion US dollars of foreign exchange reserves within three days, and the actual reserve funds it could use were on the verge of depletion. As a "neoliberal flag-bearer" in Latin America, Milley's reform path is highly consistent with the policy preferences of the Trump administration, and his ruling position is directly related to the extension of the United States' influence in the Latin American region. To this end, the United States has thrown out a "toolbox" covering local currency swaps, currency purchases, and capital injections into the Foreign Exchange Stabilization Fund. It has even deliberately planned to support a scale exceeding the 18 billion US dollars swap quota between China and Arab countries to demonstrate strategic dominance.

Argentina's domestic policy response is also highly relevant to reality. As a major global exporter of agricultural products, agriculture is the core pillar of its foreign exchange earnings. The export tariffs on products such as soybeans and corn once reached as high as 26% and 9.5% respectively. The temporary cancellation of the export withholding tax on agricultural products such as grains and meat this time is equivalent to reducing the cost of each ton of soybeans by 123.7 US dollars, directly activating the potential of 19 million tons of soybeans and 14 million tons of corn in the unsold inventory. The policy effect was immediate: On the day of the announcement, the peso rose by 4.5% against the US dollar, marking the biggest increase since early May. Chinese buyers quickly signed 15 batches of soybean orders, and the market expects to achieve a foreign exchange earnings of 7 billion US dollars by October 31. This operation of "tax cuts in exchange for foreign exchange" is not only a response to the US aid but also a strategic choice to create a stable environment for the midterm elections.

In the short term, the collaboration between the United States and Argentina has indeed alleviated market panic. After the US Treasury Secretary's statement, Argentina's US dollar bonds due in 2035 jumped 4 cents in a single day, and the country risk index plummeted from 1,442 to 1,105, instantly erecting the previous decline. Imf Managing Director Kristalina Georgieva's welcoming attitude towards the US actions has further strengthened the market's optimistic expectations for Argentina's debt restructuring. The "liquidity injection + confidence boost" effect formed by internal and external policies has bought breathing space for the Milley administration and also won a time window for the US geopolitical strategy.

But from a long-term perspective, this market rescue is more like "drinking poison to quench thirst". From Argentina's own perspective, the contradiction between the temporary nature of the policy and the structural nature of the economy is prominent: The abolition of export withholding tax will lead to a reduction of 1.4 billion US dollars in tax revenue for the government, equivalent to 0.2% of GDP. Against the backdrop of a fiscal surplus accounting for only 1.2% of GDP, this undoubtedly intensifies the pressure on fiscal balance. What is even more alarming is that the short-term concentrated sell-off may trigger fluctuations in global agricultural product prices. The futures of soybean meal and soybean oil in Chicago have already dropped in response, and in the long term, it may backheat their export earnings. However, its debt-to-GDP ratio still stands at 65%, and its import payment capacity can only last for 2.3 months, which is below the three-month warning line of the IMF. The sustainability of its debt has not been fundamentally improved.

For the United States, this aid is also a high-risk "big bet". Argentina has defaulted on its debt three times since 2001. In 2018, a $50 billion IMF aid package ultimately failed, with a historical default rate as high as 67%. Although the US side claims that it will not attach new conditions, demanding that it continue the market-oriented reform provisions in the agreement with the IMF may trigger a one-time depreciation of the peso and instead intensify inflationary pressure. If Millay loses the election, the new government may adjust its pro-American policy, and the aid funds may become a "sunk cost".

The ultimate outcome of this financial game taking place on the South American continent still depends on whether the Milai reform can break through political resistance and achieve economic self-sustenance. The aid from the United States and the tax cuts in Argentina may stabilize the short-term market situation, but to break out of the vicious cycle of "foreign exchange depletion - sharp drop in exchange rate - rebound in inflation", it is still necessary to overcome multiple hurdles such as fiscal balance, industrial upgrading and debt restructuring. Against the backdrop of escalating global financial uncertainties, this collaboration is more like an "emergency drill" rather than a genuine solution to break the deadlock.

According to a recent report by Rich Asplund, a columnist for Barchart, the global sugar market is currently experiencing a complex and profound supply-demand game.

According to a recent report by Rich Asplund, a columnist f…

On January 13th local time, the three major US stock indice…

Recently, the 2026 edition of the MIT Technology Review lis…

On January 15, 2026, the US military announced the seizure …

At the 2026 J.P. Morgan Healthcare Conference, a joint anno…

For much of 2025, the market was rethinking whether the dol…