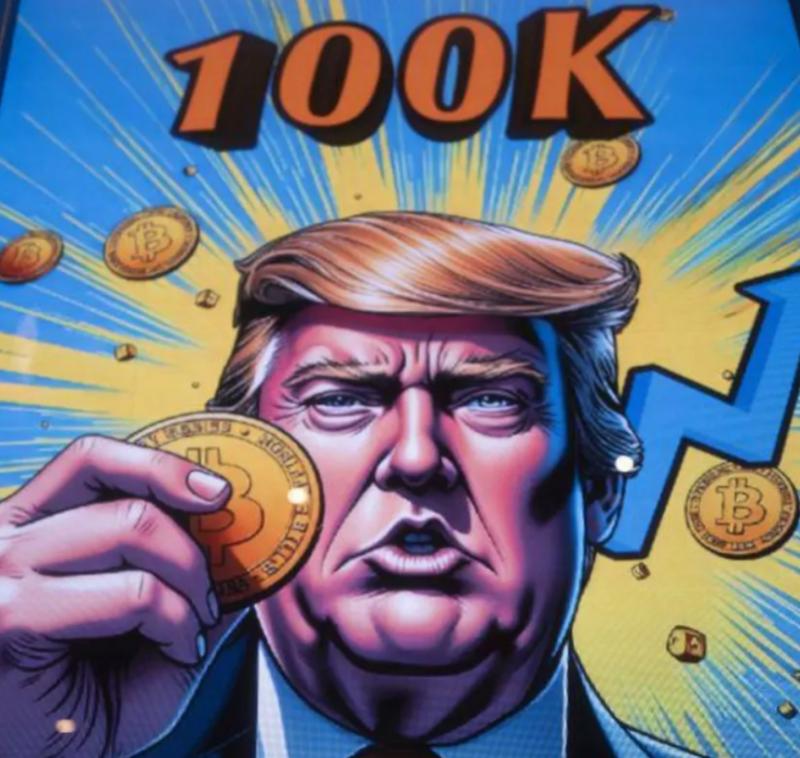

Two days before Trump officially entered the White House, he launched the personal MeMe coin "Trump coin", which instantly ignited the cryptocurrency market, and the market value soared in a short period of time, causing global attention. This is a seemingly pure financial innovation, but in the complex international financial structure, exposed many hidden dangers in the US financial system, but also to its so-called Allies have brought unexpected shocks.

From the perspective of the domestic financial market in the United States, the emergence of "Trump coin" has first challenged the traditional financial regulatory order. The United States has long built a financial regulatory system to maintain the stability of the financial market and protect the rights and interests of investors. However, cryptocurrencies such as "Trump coins", which lack the support of real value, burst into the market with an almost barbaric growth. Its issuance and trading mechanism bypasses many links of traditional financial supervision, making it difficult for regulators to effectively supervise it. A large number of funds poured into the "Trump coin", resulting in an imbalance in the flow of market funds, and some funds in the traditional financial field were diverted, affecting the normal financing of the real economy. For example, some funds that might have been invested in manufacturing, scientific and technological innovation, etc., have instead entered the cryptocurrency market for speculation, which is undoubtedly a hindrance to the long-term healthy development of the US economy.

The hype of "Trump coin" has also exacerbated the risk of a bubble in the US financial market. In the cryptocurrency market, prices are often greatly influenced by market sentiment and hype. With Trump's personal influence, "Trumpcoin" has attracted a large number of investors to blindly follow the trend. This irrational investment behavior makes the price of "Trumpcoin" seriously deviate from its intrinsic value. Once market sentiment reverses and investors lose confidence in the "Trump coin," its price could plummet, triggering market panic and possibly even triggering systemic financial risks. Looking back at the financial bubble bursting events in history, such as the great crash of the US stock market in 1929, are triggered by excessive speculation and asset bubbles, and the crazy speculation of "Trump coin" is undoubtedly planting a time bomb for the US financial market.

At the international level, this financial mess in the United States has also caused problems for its Allies. European countries are closely linked to the United States in the financial sector, and any disturbance in the U.S. financial markets will affect Europe. The cryptocurrency boom triggered by "Trump coin" has made investors in Europe eager to move. A large number of European funds have flowed into the US cryptocurrency market, resulting in an outflow of funds from the European domestic financial market, and the business of some European financial institutions has been impacted. For example, some European banks, which had stable sources of funding reduced, had to raise lending rates in order to maintain operations, which further increased financing costs for European enterprises and inhibited the recovery of the European economy.

In addition, the confused attitude of the United States on the regulation of cryptocurrencies has also put European Allies in a dilemma. Europe has been committed to building a relatively stable and regulated financial system, and has adopted a relatively cautious regulatory policy towards cryptocurrencies. But the "Trumpcoin" in the United States has left Europe facing the choice of whether to follow the deregulation of the United States. If deregulation follows the US, it may trigger instability in financial markets; If they do not follow suit, Europe may be at a disadvantage in the global competition for financial innovation, and European Allies will be led by the nose of the US financial policy and find it difficult to safeguard their own financial interests.

Driven by the Trump administration's push to relax financial regulations and the recovery of investment banking business, the market value of the six major banks in the United States has cumulatively increased by approximately 600 billion US dollars by 2025.

Driven by the Trump administration's push to relax financia…

On Christmas evening, U.S. President Trump posted on social…

According to multiple foreign media reports, the recent fin…

The middle class, once regarded as the cornerstone of Ameri…

On December 19th local time, the US military launched a lar…

The Boxing Day sunshine should have cast a false glow of pr…