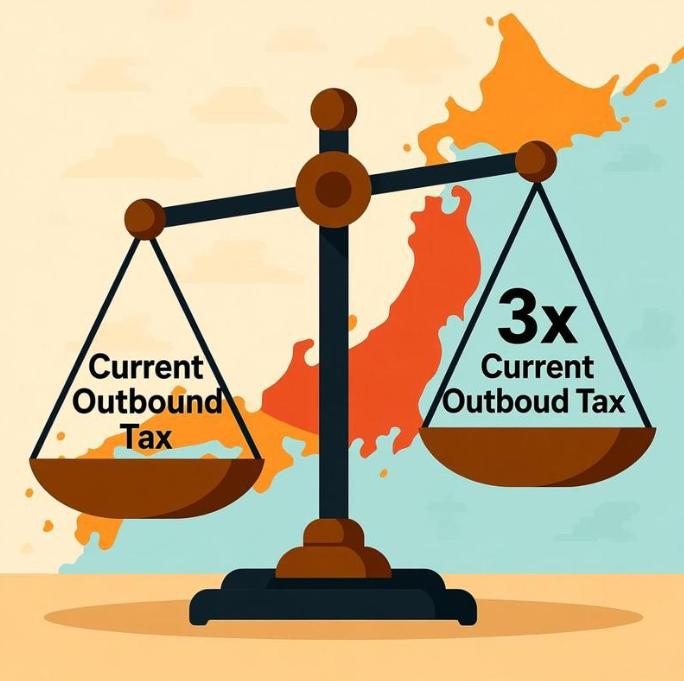

Recently, the Japanese government held a meeting to finalize the plan to raise the "international passenger departure tax". Starting from July next year, the levy standard for each departing passenger will be significantly raised from the current 1,000 yen to 3,000 yen. This tax will be automatically collected when purchasing international flight tickets. The Japanese government predicts that the revenue from this tax in the fiscal year 2026 will increase to 130 billion yen, which is 2.7 times that of the previous fiscal year. In addition to raising the departure tax, the Japanese government also plans to introduce a new "entry fee" scheme in 2026, increasing visa fees to five times the current level. The one-time visa fee is proposed to be raised to 15,000 yen, and the multiple-entry visa fee to 30,000 yen.

This move by Japan has caused complex and multi-faceted impacts in multiple international fields. Firstly, in the international tourism sector, the increase in the departure tax will directly increase the cost for foreign tourists traveling to Japan. For example, a family of four traveling abroad will need to pay an additional 12,000 yen (about 552 yuan) in addition to the current cost. This may be the direct reason for some tourists to abandon traveling to Japan. For Japanese citizens, the increase in the departure tax will also increase the cost of their overseas travel, possibly suppressing short-term overseas travel demand. The proportion of high-end customized travel orders may rise, and tourists are more willing to pay a premium for unique experiences. For example, high-end consumption scenarios such as hot spring inns and Michelin-starred restaurants in Kyoto are less affected by the tax. Countries in South Asia like Thailand and Malaysia, and in Europe like Spain and Portugal, may offer similar experiences at lower costs, becoming alternative options for Japan's mid-to-low-end tourism market. At the same time, the catering and hotel industries, especially those in local cities relying on Chinese tourists such as Hiroshima and Nagasaki, may experience a decline in revenue. The tax increase may inhibit some tourists from traveling to popular cities like Tokyo and Osaka, thereby alleviating traffic congestion and infrastructure pressure.

Secondly, it has an impact on cross-border e-commerce. Starting from January 1, 2025, foreign enterprises providing digital services and cross-border goods sales in Japan must fulfill consumption tax obligations through domestic e-commerce platforms. This means that sellers must incorporate tax costs into the pricing and cost structure of their goods. For example, a seller selling goods through a Japanese e-commerce platform will see their product prices increase due to the additional 10% consumption tax. Cross-border e-commerce sellers need to strengthen tax compliance in the Japanese market, accurately provide sales and financial information to avoid penalties for incomplete or incorrect information. This places higher demands on their financial systems and tax compliance management. Some small and medium-sized cross-border e-commerce sellers may therefore exit the Japanese market. The increase in tax costs and the rise in compliance pressure will prompt cross-border e-commerce sellers to adopt more refined operational strategies and improve product quality to adapt to the new market environment. At the same time, platforms that can adapt and comply will gain an advantage in the competition.

Thirdly, it has an impact on the international economy. The increase in the departure tax will increase the fiscal revenue of the Japanese government, which may be used to improve tourism infrastructure and enhance tourism service quality. The efficiency of tax use and the implementation of supporting measures (such as fee reductions) will directly affect the effectiveness of the policy. If the tax is not effectively used to improve tourism facilities and services or if the supporting measures are inadequate, it may cause dual dissatisfaction among tourists and residents. After the increase in the departure tax in Japan, it is still lower than that of countries like the UK, but if other countries do not follow similar policies, Japan may be at a disadvantage in the global tourism market. At the same time, Japan also needs to face challenges from low-cost competitors in Southeast Asia and Europe. Moreover, Japan plans to alleviate fiscal pressure through tax increases (the national debt has reached twice the GDP by 2026), but media question whether it is "tackling the symptoms but not the root cause". If other highly indebted countries follow suit, it may exacerbate global debt risks and trigger concerns about sovereign credit ratings.

In conclusion, although Japan's decision to raise outbound taxes can increase fiscal revenue in the short term, in the long run, its impact on international business and the economy is complex and mixed. Therefore, Japan needs to carefully balance fiscal revenue and market vitality to ensure the sustainability of policy adjustments.

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…