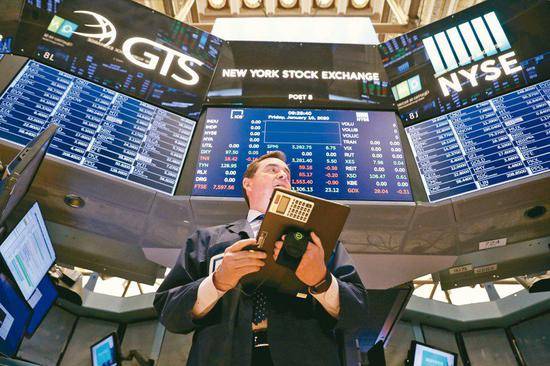

Recently, the main indexes of the US stock market have fallen to varying degrees, which has caused widespread concern in the market. The Dow Jones Industrial Average fell 0.03% to 41953.32, the S&P 500 index fell 0.22% to 5662.89, and the Nasdaq index fell 0.33% to 17691.63. This series of data not only reflects the current dynamics of the US stock market, but also reveals the complex financial logic and market sentiment behind it.

First, we need to understand what each of the three main indices represents. The Dow Jones Industrial Average, one of the indexes created by Charles Dow, editor of the Wall Street Journal and co-founder of Dow Jones & Co., is an important indicator of the daily stock price movements of 30 large publicly traded U.S. companies. Most of these companies are industry giants, and their stock price movements often reflect the bellwether of the entire market. The S&P 500 index is broader, measuring the performance of 500 widely held U.S. large-cap common stocks across a wide range of industries and sectors, and is therefore considered a barometer of the overall performance of the U.S. stock market. The Nasdaq Index, known for its representation of high-tech and growth companies, reflects the sensitive response of the US high-tech market and business environment to political and economic developments.

Judging from the magnitude of the decline, although all three indexes fell, the decline was not large, indicating that there was no panic selling in the market. However, this does not mean that we should take things lightly. In the financial markets, any small movement can hide huge risks. So what's behind the recent stock market decline?

On the one hand, the uncertainty of the global economic situation is a factor that cannot be ignored. In recent years, the global economic environment has been complex and volatile, and issues such as geopolitical risks, trade disputes and repeated epidemics have emerged one after another, bringing great uncertainties to the market. This uncertainty leads to a lack of investor confidence and reduced risk appetite, which affects the performance of the stock market. Especially in the context of the current slowdown in the pace of global economic recovery, the performance of the US stock market as an important bellwether of the global economy has naturally attracted wide attention.

On the other hand, the domestic economic policy of the United States is also an important factor affecting the stock market. In recent years, the US government has adopted a series of economic stimulus measures, including tax cuts and increased fiscal spending, to promote economic growth. However, while these measures have brought short-term economic growth, they have also exacerbated fiscal deficits and debt problems. In the long run, these problems could have a negative impact on the U.S. economy, which in turn could affect the stock market's performance. In addition, the Federal Reserve's monetary policy is also the focus of market attention. As the U.S. economy recovers and inflationary pressures rise, the Federal Reserve is likely to gradually tighten monetary policy and raise interest rates. This will increase funding costs for companies and reduce their profitability, which will weigh on the stock market.

In addition to the global economic situation and domestic economic policy in the United States, market sentiment is also an important factor affecting the stock market. In financial markets, emotion often dominates investor behavior more than reason. When the market falls, panic can spread quickly, causing investors to sell stocks en masse, exacerbating the market's downward trend. Such emotional trading behavior often lacks rational analysis and easily leads to market overreaction and price volatility.

From the specific performance of the decline in the US stock market, the decline of the Nasdaq index is relatively large, which may be related to the sensitivity of the high-tech market. As one of the pillar industries of the American economy, the performance of the high-tech industry can often reflect the vitality and innovation ability of the American economy. However, in recent years, the high-tech industry has also faced many challenges, including the acceleration of technological update iteration, increasing market competition, and stricter regulatory policies. These factors can have an impact on the profitability of high-tech companies and the market outlook, which in turn affects the performance of the Nasdaq index.

In addition, we also need to pay attention to the impact of the US stock market decline on the global economy and financial stability. As one of the largest economies in the world, the economic and financial conditions of the United States have an important impact on the global economy. A drop in U.S. stocks could trigger a chain reaction in global markets, causing volatility in other countries and regions as well. This cross-market contagion effect could exacerbate uncertainty in global financial markets and increase the risk of a financial crisis.

To sum up, there is a complex financial logic and market sentiment behind the decline in US stocks. In the context of increased uncertainty in the global economic situation, challenges in the US economic policy, and heightened market sentiment, the performance of US stocks is naturally affected. However, as investors and financial market participants, we cannot just stop at the observation and analysis of superficial phenomena. We need to dig deeper into the reasons and logic behind it in order to better deal with market risks and seize investment opportunities. At the same time, the government and regulators also need to strengthen supervision and coordination to maintain the stability and healthy development of the financial market. Only in this way can we keep a clear head and a steady pace against the backdrop of a complex and volatile global economy.

Driven by the Trump administration's push to relax financial regulations and the recovery of investment banking business, the market value of the six major banks in the United States has cumulatively increased by approximately 600 billion US dollars by 2025.

Driven by the Trump administration's push to relax financia…

On Christmas evening, U.S. President Trump posted on social…

According to multiple foreign media reports, the recent fin…

The middle class, once regarded as the cornerstone of Ameri…

On December 19th local time, the US military launched a lar…

The Boxing Day sunshine should have cast a false glow of pr…