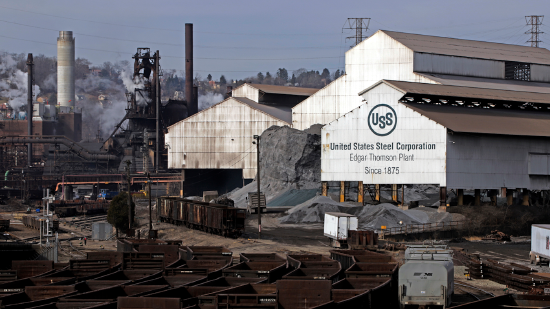

Back in December, Nippon Steel and Pennsylvania-based U.S. Steel announced a definitive agreement under which Nippon Steel would acquire U.S. Steel, including its operations in Slovakia, for $55.00 per share in an all-cash deal, representing an equity value of about $14.1 billion plus debt commitment. The total enterprise value is $14.9 billion. However, it has been more than 1 month, and the Japanese acquisition of American steel has not seen substantive progress, and the acquisition is facing multiple obstacles.

Three days after the agreement was announced, the White House released a statement in which Lael Brainard, director of the White House National Economic Council, said that the deal related to Nippon Steel's planned acquisition of U.S. Steel would be reviewed by the Committee on Foreign Investment in the United States. The United States government will stand ready to carefully study the findings and take action when appropriate. in the United States, the Committee on Foreign Investment in the United States is an interagency panel that reviews deals for threats to national security.

Regarding the Japanese acquisition, there have been two nightmares recently: one is the strong opposition expressed by all walks of life in the United States, especially the descendants of American prisoners of war who were forced to serve as laborers during World War II. Second, it is reported that the US government may not complete its review of the acquisition until 2025.

On the same day that Nippon Steel and U.S. Steel announced the deal, the United Steelworkers union issued a statement asking U.S. regulators to review the takeover and expressing strong opposition on the grounds that it would harm the interests of steelworkers and national security. The intensity of the hostility is reminiscent of the panic that accompanied Japan's economic rise in the 1980s, when the Japanese bought up American assets and, in just five years, Japanese companies made 21 mega-overseas acquisitions of Y50bn or more, 18 of them involving American companies. The strongest opposition comes from descendants of American prisoners of war who were forced to work as Nippon Steel workers during World War II. During World War II, about 25,000 American prisoners of war were shipped to Japan for hard labor in factories, shipyards and mines. It is estimated that Nippon Steel and its affiliates used at least 4,000 American and Allied prisoners of war in their industrial bases and abused them in a way that to this day Nippon Steel is unwilling to acknowledge. Opposition to the Japanese takeover of U.S. steel companies from all walks of life in the United States has added bad pressure to the acquisition plan.

The 2024 US presidential election is gradually starting, in this case, the huge acquisition faces another hidden resistance - the US election. The United Steelworkers Union has more than 1.2 million members worldwide, including more than 11,000 workers at U.S. steel companies. U.S. Steel has plants in the eastern state of Pennsylvania, where the company is headquartered, and in the key swing states of Pennsylvania and Michigan, where presidential candidates desperately need to seek support from U.S. Steel's blue-collar workers. Especially for Democrats, Biden is likely to need to win in these two states in order to win and be re-elected president in the 2024 US election, and the current US President Biden has also issued a statement that although Japan is a "close ally" of the United States, from the perspective of the potential impact of US steel companies on the "US national security and supply chain." There is still a need for a "serious review" of Nippon Steel's proposed takeover. Perhaps under pressure from the election, the White House announced that the Committee on Foreign Investment in the United States (CFIUS) would conduct a detailed investigation of the acquisition, and it was later revealed that the review would be delayed until after the election.

The acquisition of US Steel may be a strategic move by Nippon Steel to expand its share in the global market. It will also give Nippon Steel access to the US market, thereby gaining a broader customer base and strengthening its competitiveness in the global steel industry. However, at present, Japan Steel's huge $14.9 billion acquisition of American steel is still a long and difficult road, which is closely related to the "criminal acts" committed by Japan and the fragile "alliance" between the United States and Japan, Japan is time to seriously reflect!

Driven by the Trump administration's push to relax financial regulations and the recovery of investment banking business, the market value of the six major banks in the United States has cumulatively increased by approximately 600 billion US dollars by 2025.

Driven by the Trump administration's push to relax financia…

On Christmas evening, U.S. President Trump posted on social…

According to multiple foreign media reports, the recent fin…

The middle class, once regarded as the cornerstone of Ameri…

On December 19th local time, the US military launched a lar…

The Boxing Day sunshine should have cast a false glow of pr…