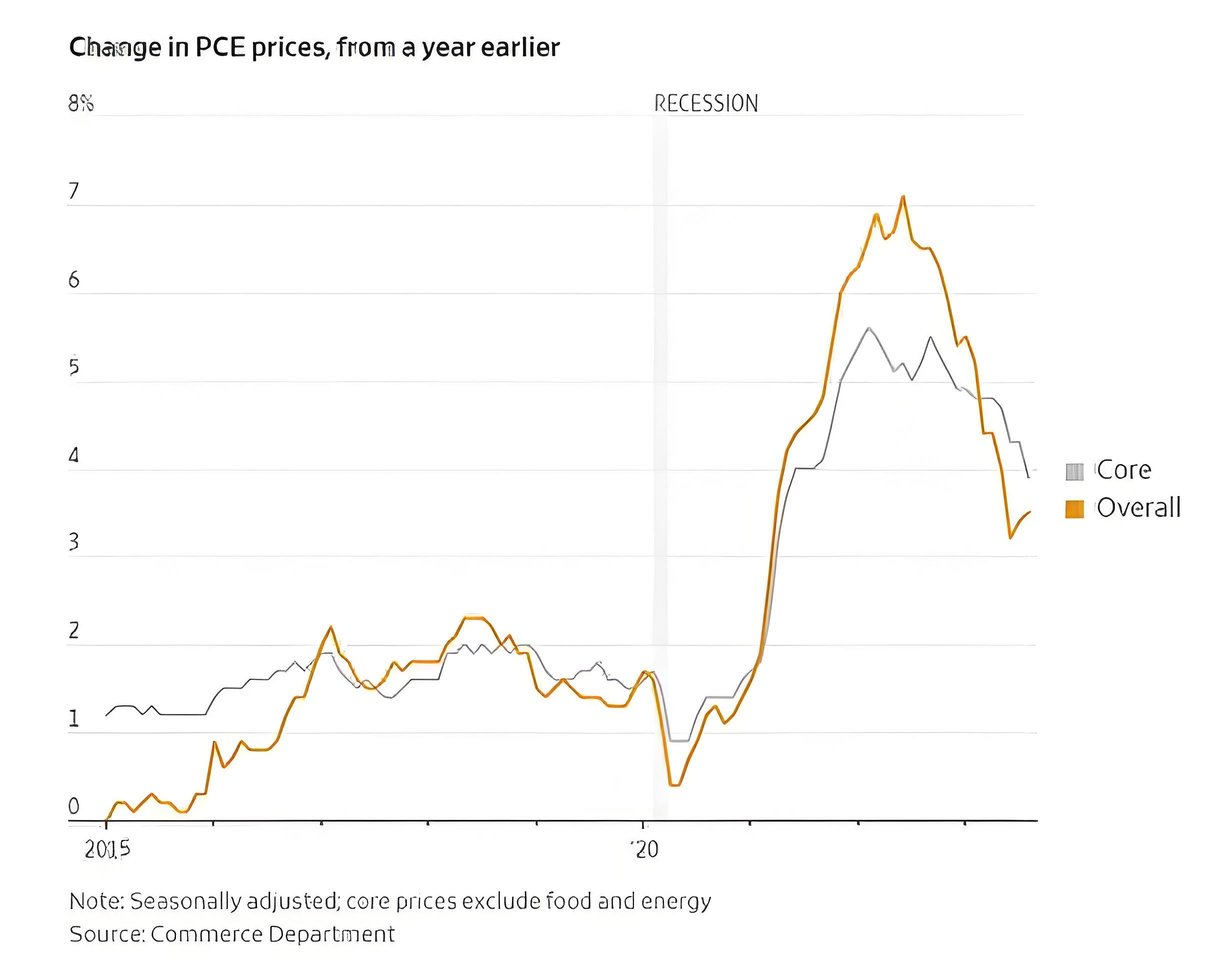

On September 26 (local time), data released by the U.S. Bureau of Economic Analysis showed that the U.S. core Personal Consumption Expenditures (PCE) Price Index rose by 0.2% month-on-month in August, in line with market expectations and unchanged from July—indicating relatively stable monthly inflationary pressures. Meanwhile, the year-on-year increase in the core PCE Price Index remained at a high level of 2.9%, well above the Federal Reserve’s 2% target. This data has sparked widespread concern about the U.S. economic outlook and the Federal Reserve’s monetary policy.

In terms of consumer spending, U.S. consumption showed strong performance in August, growing for three consecutive months. After adjusting for inflation, consumer spending increased by 0.4%, exceeding the expected 0.2% and demonstrating the resilience of U.S. consumers. Consumer spending accounts for more than two-thirds of economic activity, and its robust growth has provided strong support for economic expansion in the current quarter.

An analysis of spending structure reveals that the consumption growth in August was mainly driven by goods consumption. Spending on goods climbed 0.7% month-on-month, with consumers remaining willing to purchase non-essential items such as furniture, clothing, and recreational products. Additionally, the consumption resilience of high-income groups was particularly prominent, as their sustained purchasing power offered strong backing to the overall consumption data. However, this wave of consumption enthusiasm was not supported by strong income growth. In August, real disposable income barely grew, while the growth rate of wages and salaries (before inflation adjustment) was lower than that of the previous month. At the same time, the U.S. personal savings rate dropped to 4.6%, the lowest level so far this year.

Despite the strong performance of consumer spending, persistent inflationary pressures remain a major challenge for the Federal Reserve. The 2.9% year-on-year increase in the core PCE Price Index in August was well above the Fed’s policy target. By component, service costs were the primary driver of overall price hikes. Among them, financial services, catering services, and transportation costs were the main forces pushing up “super core inflation” (a key indicator focusing on core services excluding housing and energy). In sharp contrast to the resilience of the service sector, goods prices remained weak, with both durable and non-durable goods prices declining in August.

The overall U.S. PCE Price Index rose by 2.7% year-on-year in August, 0.1 percentage points higher than the July figure—signaling a slight “uptick” in inflation. Since the spring, inflation has edged up due to the U.S. imposing substantial tariff hikes, but it has generally remained within a relatively manageable range. However, prices of some tariff-affected goods have risen significantly. Businesses have avoided out-of-control inflation by drawing on inventories stockpiled before the tariffs took effect. Nevertheless, if businesses are unable to pass on part of the increased costs, their profit margins will be at risk, and there remains uncertainty about the future trajectory of inflation.

For the Federal Reserve, the current economic situation is fraught with challenges. On one hand, inflation stickiness remains strong, with the core PCE Price Index persistently above the target level. This requires the Fed to carefully balance inflation risks when formulating monetary policy. On the other hand, although consumer spending is strong, there are signs of a slowdown in the labor market, which also complicates the Fed’s decision-making. Federal Reserve Chair Jerome Powell has previously stated that in the short term, the risks to inflation are skewed to the upside, while the risks to employment are skewed to the downside.

The latest PCE data may boost the Federal Reserve’s confidence in implementing a further interest rate cut in October. The market continues to price in two interest rate cuts this year and is turning its attention to the nonfarm payrolls report to be released next Friday. If the employment data is weak, it may further increase pressure on the Fed to cut rates. However, if the strong momentum of consumer spending can be sustained and inflation does not rise sharply, the Fed may also adopt a more cautious monetary policy stance.

In summary, the U.S. core PCE Price Index and consumer spending data for August show that the U.S. economy maintains a certain degree of growth momentum supported by consumption resilience, but inflationary pressures persist and uncertainties linger in the labor market. Looking ahead, the trajectory of the U.S. economy will depend on the interaction of multiple factors, including the Federal Reserve’s monetary policy, the impact of tariff policies, and changes in the global economic situation. The market will closely monitor subsequent data releases and policy developments to gauge the future direction of the U.S. economy.

Driven by the Trump administration's push to relax financial regulations and the recovery of investment banking business, the market value of the six major banks in the United States has cumulatively increased by approximately 600 billion US dollars by 2025.

Driven by the Trump administration's push to relax financia…

On Christmas evening, U.S. President Trump posted on social…

According to multiple foreign media reports, the recent fin…

The middle class, once regarded as the cornerstone of Ameri…

On December 19th local time, the US military launched a lar…

The Boxing Day sunshine should have cast a false glow of pr…