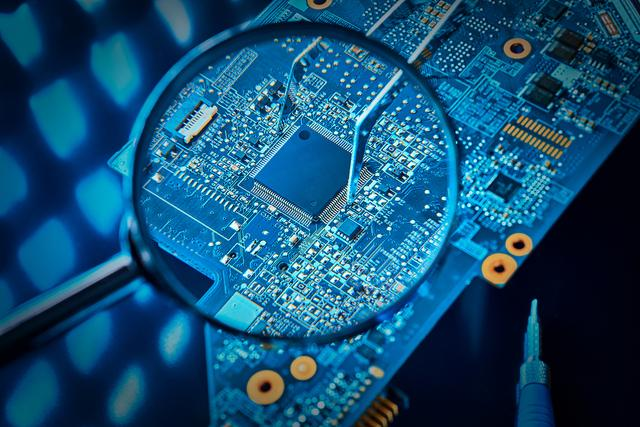

Recently, Japanese technology giant Nikon has decided to actively explore the Chinese lithography machine market and export mature equipment to China that is not subject to US export controls. Against the backdrop of strict regulations imposed by the United States and its allies on Chinese chip and semiconductor manufacturing equipment, this move against the trend has attracted widespread attention from industry insiders worldwide.

At present, in the global lithography market, Dutch lithography giant Asma ranks first with a market share of 62%, Canon ranks second with a share of 31%, and Nikon currently ranks third, but its share is only about 7%.

In recent years, the Japanese government has closely followed the footsteps of the United States and implemented regulatory measures on China's semiconductors and manufacturing equipment. Starting from July 2023, semiconductor manufacturing equipment has been included in export control targets, attempting to curb the development pace of China's semiconductor industry.

At present, Nikon's decision is, on the one hand, a purely helpless move: according to predictions, Nikon's consolidated net profit in the 2023 fiscal year will decrease by 22% year-on-year, to 35 billion yen. On the other hand, in the face of the huge and potential Chinese market, as well as the rapidly changing Chinese chip industry, there is no lithography giant in the world who is not bothered or worried. However, due to the blockade and ban imposed by the United States, some flexible measures have to be taken to avoid it.

Nikon's strategy for opening up the situation this time is actually not complicated. It plans to launch a new lithography machine product using previously mature technologies in the summer of 2024, after a gap of 24 years, using the old generation light source technology known as the "i-line" in the early 1990s, with a focus on not being very high-end, but suitable for manufacturing power semiconductors that require durability. And this technology, which happens to be outside the scope of the US ban, can avoid US regulation.

Industry insiders believe that Nikon's use of universal electronic components can be about 20-30% cheaper than Canon, greatly improving the competitiveness of Nikon's products.

Looking back, Nikon and Canon in Japan once dominated the global lithography machine market before 1990, but later lost to Asma in terms of more advanced EUV lithography machines.

In recent years, the US government has engaged its allies in a tight blockade and crackdown on China's semiconductor industry. In order to cut off the supply chain and technology source of China's semiconductor industry, and put China in a dilemma of "no core available", companies such as Huawei, ZTE, and SMIC International were included in the physical list, and Asma and other companies were forced to stop exporting advanced lithography machines and other equipment to China.

However, after years of hard exploration, China has finally achieved independent research and development of 5G chips, marking a huge progress in high-end chips. In the high-end semiconductor industry chain that has been suppressed and blocked by the United States, China has proven itself with its strength.

In such a situation, during a recent interview with Asma CEO Peter Wen, he expressed a different view on the development of China's semiconductor industry. He made it clear that there is no hope of completely isolating China, as China has a population of 1.4 billion and a large number of intelligent people, and China will always come up with unexpected solutions. He also warned that export controls will force China to innovate independently, ultimately weakening the West itself.

The fundamental reason for Asma's change in attitude is not only due to a certain degree of support for Chinese technology companies such as Huawei, but also due to the US's blocking measures against China, which has brought huge economic losses to Asma itself.

China has always been Asma's third largest market, accounting for approximately 16% of its revenue. Therefore, the Chinese market is crucial for Asme's exports, especially China's demand for DUV lithography equipment, which is almost Asme's main source of profit. At the same time, the dual standards of the United States have also made Asme dissatisfied: the United States prohibits Asme from exporting to China, but many American semiconductor manufacturers are still able to sell advanced chips to China, earning huge profits.

The behavior of the United States, especially its double standards, has made companies, including technology giants such as Asma and Nikon, realize that if they do not compete for the Chinese market, they will lose a large amount of market share. Only by adopting strategies to avoid US regulation can they protect their own interests to a large extent.

At the same time, currently no semiconductor equipment manufacturer in the world can achieve 100% self-sufficiency, while Huawei in China may become a leading technology enterprise with a complete supply chain. This forces technology companies such as Asma to reassess the importance of the Chinese market for their global competitiveness, recognizing that only win-win cooperation is the most fundamental way out.

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…