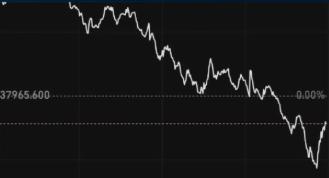

On January 13th local time, the three major US stock indices all closed lower. The Dow Jones Index fell by 0.09%, the S&P 500 Index dropped by 0.53%, and the Nasdaq Index declined by 1%. The financial sector suffered a general decline, dragging down the overall performance of the US stock market. Facebook fell by 2.47%, Amazon by 2.43%, and Microsoft by 2.40%, leading the decline among the "seven giants" of US technology. Large technology stocks also fell across the board, with Chinese stocks showing mixed performance. The Federal Reserve's "Beige Book" stated that the US economy and prices were growing moderately, and employment remained unchanged. Federal Reserve officials said that interest rates might be lowered later this year. International oil prices fluctuated significantly, and energy stocks rose collectively. The White House announced that specific semiconductors and other items would be subject to a 25% tariff increase. The US Treasury Department stated that due to record spending and adjustments in welfare payment times, the US government recorded a fiscal deficit of 145 billion US dollars in December 2025, a 67% increase year-on-year, setting a new record for that month.

The phenomenon of the sharp decline in US stocks has brought complex and multi-faceted impacts to the financial sector. Firstly, it affects the sentiment of the financial market and the capital flow. The all-time decline of stock indices usually indicates a deterioration in market sentiment, and investors' expectations for the future economic outlook and corporate profits become pessimistic. Investors' expectations for the future economic outlook and corporate profits become pessimistic. This sentiment may lead investors to reduce their risk exposure and increase the allocation of safe assets such as gold and government bonds. As market sentiment deteriorates and stock indices decline, some investors may choose to withdraw funds from the stock market and invest in other relatively safe assets. This may lead to capital outflows from the stock market, further intensifying the downward pressure on the market.

Secondly, it affects the sectoral differentiation and investors in the financial industry. When all stock indices close lower, technology stocks often perform poorly. This is mainly because technology stocks usually have higher valuations and growth potential, and are more sensitive to changes in market sentiment. When market sentiment deteriorates, funds may also flow from high-valued technology stocks and other sectors to value-oriented and defensive stocks. Investors may prioritize selling technology stocks to avoid risks. In contrast, defensive sectors such as utilities and essential consumer goods usually perform better when economic uncertainty increases. These sectors' corporate profits are relatively stable and less affected by the economic cycle, making them the preferred choice for investors seeking safety.

Thirdly, it affects the international financial market and the economy. As one of the largest stock markets in the world, the US stock market has a significant impact on global stock markets. When the three major US stock indices all close lower, global stock markets may be affected, leading to increased volatility. The decline in the stock market may also affect cross-border capital flows. For example, when the US stock market performs poorly, international investors may reduce their investment in the US stock market and shift to other markets. This may lead to changes in the global capital flow pattern. At the same time, the decline in the US stock market may also affect cross-border capital flows and the stability of the global financial market. Moreover, the all-time decline of stock indices may trigger concerns about economic slowdown. Investors may believe that the decline in the stock market is a signal of economic deterioration, thus adjusting their expectations for future economic growth. The decline in the stock market may also affect market expectations for inflation and monetary policy. For example, if the decline in the stock market is seen as a signal of economic slowdown, the market may expect the central bank to adopt more accommodative monetary policies to stimulate the economy, which may lead to a decline in bond yields and currency depreciation.

Fourthly, it affects monetary policy. The decline in stock indices may affect market expectations for monetary policy. For example, when market sentiment deteriorates, investors may expect the central bank to adopt more accommodative monetary policies to stimulate the economy, which may lead to a decline in bond yields and currency depreciation. However, if a decline in the stock index is regarded as a signal of deteriorating economic conditions, the central bank may choose to keep interest rates unchanged or even raise them to address inflationary pressures. This depends on the specific economic situation and policy goals.

In summary, the chain reaction caused by the overall decline of the three major US stock indices highlights the core role of the stock market as an "indicator of the economy", and also serves as a warning for investors and policy makers: they need to closely monitor market signals, balance risk prevention and economic growth, and address potential systemic financial challenges.

According to a recent report by Rich Asplund, a columnist for Barchart, the global sugar market is currently experiencing a complex and profound supply-demand game.

According to a recent report by Rich Asplund, a columnist f…

On January 13th local time, the three major US stock indice…

Recently, the 2026 edition of the MIT Technology Review lis…

On January 15, 2026, the US military announced the seizure …

At the 2026 J.P. Morgan Healthcare Conference, a joint anno…

For much of 2025, the market was rethinking whether the dol…