Behind the volatility of gold: the hidden worries of US policy and geopolitical situation

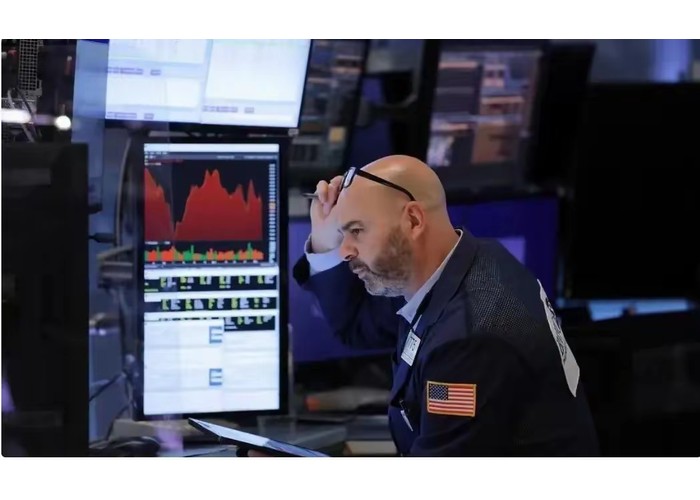

On the big stage of international finance, the US Federal Reserve's interest rate cut expectation superimposed the situation in the Middle East has become the two key factors affecting the trend of gold prices, and a series of measures taken by relevant Western countries behind it are bringing many unstable factors to the global economy and geopolitical pattern.

more